Showing posts with label royal commission. Show all posts

Showing posts with label royal commission. Show all posts

Monday 18 December 2017

And right-wing politicians still wonder why the general public is in favour of a genuine federal royal commission into banks and bankers?

ABC News, 14 December 2017:

The Commonwealth Bank's ongoing woes around alleged systematic money laundering operations by criminal gangs and terrorists have deepened, with fresh claims the contraventions are continuing.

The allegations were raised as AUSTRAC filed a further 100 alleged breaches of Anti-Money Laundering/Counter Terrorism Financing (AML/CTF) as part of the existing Federal Court proceeding being run by the Government's financial transactions watchdog.

In one case, a client who had been convicted of terrorism charges in Lebanon, and was known to have tried to organise funding for terrorist acts in Australia, was given 30 days' notice of the closure of his CBA account before AUSTRAC was even alerted.

He also managed to withdraw funds from the account more than a week after it was supposedly closed.

"On 20 July 2017, CommBank erroneously processed a transfer of $5,000 from CommBank Account 184 [the alleged terrorist funder] to an account held by Person 138 [his brother] in Lebanon in spite of suspecting terrorism financing in relation to an identical attempted transfer on 19 June 2017," AUSTRAC's new court statement alleged….

Royal Commission Into

Misconduct In The Banking, Superannuation And Financial Services Industry, Draft Terms of Reference, 30 November 2017.

Labels:

banks and bankers,

ethics,

royal commission

Sunday 3 December 2017

SA Royal Commission into Murray-Darling Basin management and alleged water theft

The NSW Berejiklian Government will not be happy with this………

ABC News, 30 November 2017:

Allegations of water theft upstream in the Murray-Darling Basin (MDB) have prompted South Australian Premier Jay Weatherill to launch a state royal commission to identify any perpetrators.

New South Wales and Queensland were slapped with a scathing assessment of compliance with the MDB Plan on Saturday, after a review found poor levels of enforcement.

The review also found a lack of transparency surrounding the states' water management, along with Victoria's.

Mr Weatherill said the report did not go far enough and announced a royal commission.

"The review that was handed down did not go into detailed findings of who committed water theft and who behaved inappropriately in relation to the river," he said.

"There have been no specific findings in relation to individuals or groups of individuals."

When asked whether a state royal commission could force bureaucrats from interstate to give evidence, Mr Weatherill said the royal commissioner would be given the powers of compulsion.

"And they will have no choice but to come forward," he said.

"A state-based royal commission does have the capacity to analyse things that touch on other states, provided there is a connection to South Australia.”

"That's our very clear legal advice and it's our intention to pursue this royal commission's power to their fullest extent, so we can get to the bottom of this water theft."…..

Despite labelling it "just another stunt", the Federal Government said it would cooperate with SA's royal commission.

Assistant water resources minister Anne Ruston said the issues in the basin were being addressed but the Commonwealth would not stand in the way of the commission, and neither should NSW or Victoria.

"I'd like to think they'd cooperate, certainly the Commonwealth will cooperate, we haven't got anything to hide," she said.

The Australian Government’s 25 November 2017 The Murray–Darling Basin Water Compliance Review can be read here.

Friday 1 December 2017

Pressure mounted in Australia for a royal commission into banks and Turnbull caved

It would appear that some federal government MPs and senators are becoming nervous about their party’s chances at the next general election and are looking for ways to appease the electorate.

So the politically insecure Australian Prime Minister and former merchant banker Malcolm Turnbull announced a Royal Commission into the alleged misconduct ofAustralia’s banks and other financial services entities in order to appease theses nervous nellies on his backbench.

Having been dragged kicking and screaming to this point Turnbull has made quite sure that the carefully worded Terms of Reference hides a scorpion with considerable sting in its tail:

1. c) the use by a financial services entity of superannuation members’ retirement savings for any purpose that does not meet community standards and expectations or is otherwise not in the best interest of members;

This opens the door for a sustained assault over the twelve months this commission is sitting aimed directly at the sixteen industry-based superannuation funds.

These low-fee super funds are supported by Australian unions and, it is no co-incidence that eight of the top 10 list for the 10 years to 30 June 2017 are industry funds.

Industry superannuation funds which the Turnbull Government wants to see transferred to the control of the big four banks.

No wonder the banks are now in favour of this royal commission.

It is being observed in mainstream media that; It is noteworthy that the letter to Morrison from the big four bankchairmen and CEOs seems to have been used as the template for the royalcommission announcement.

Brief Background

So the politically insecure Australian Prime Minister and former merchant banker Malcolm Turnbull announced a Royal Commission into the alleged misconduct ofAustralia’s banks and other financial services entities in order to appease theses nervous nellies on his backbench.

Having been dragged kicking and screaming to this point Turnbull has made quite sure that the carefully worded Terms of Reference hides a scorpion with considerable sting in its tail:

1. c) the use by a financial services entity of superannuation members’ retirement savings for any purpose that does not meet community standards and expectations or is otherwise not in the best interest of members;

This opens the door for a sustained assault over the twelve months this commission is sitting aimed directly at the sixteen industry-based superannuation funds.

These low-fee super funds are supported by Australian unions and, it is no co-incidence that eight of the top 10 list for the 10 years to 30 June 2017 are industry funds.

Industry superannuation funds which the Turnbull Government wants to see transferred to the control of the big four banks.

No wonder the banks are now in favour of this royal commission.

It is being observed in mainstream media that; It is noteworthy that the letter to Morrison from the big four bankchairmen and CEOs seems to have been used as the template for the royalcommission announcement.

Brief Background

ABC News, 28 November 2017:

The calls for a full inquiry have been relentless for years, emanating from a broad section of the community — from farmers, small business and households, jaded and disillusioned with the industry's rampant profiteering, fee gouging and blatant disregard for the law.

How many times can a Commonwealth Bank chairman sincerely apologise for a yet another breach of trust? What, pray tell, will be the cause of next year's?

But the overwhelming reason for an inquiry rests on just one principle — accountability.

What has been forgotten in the endless round of scandals in recent years is that the Australian banking sector is a taxpayer subsidised industry.

It's an industry that pays ridiculously bloated salaries to its leaders; that showers itself with massive bonus payments when profits are soaring but instantly demands taxpayer protection and support when the tide turns. More on that later.

A summary of bank transgressions during the past decade compiled by former Deutsche Bank analyst Mike Mangan at https://assets.documentcloud.org/documents/4310476/A-Summary-of-Bank-Transgressions-During-the-Past.pdf.

The Guardian, 28 November 2017:

A majority of Australians would support a royal commission into the banks, with this week’s Guardian Essential poll showing 64% in favour, including 62% of Coalition supporters.

With Barnaby Joyce holding out the prospect that the Nationals might formally support an inquiry into the banks when the party room meets next week, and with dissident parliamentary numbers for the proposal building, the new poll finds public support for a banking royal commission has stayed constant for two years.

Support is highest among Labor voters at 72%, and people intending to vote for someone other than the major parties (71%), but there is also clear majority support among Coalition voters and Greens voters – 62%.

ABC News, 28 November 2017:

It seems inevitable that a bill calling for a wide-ranging inquiry into banks, insurers and superannuation providers would pass the Federal Parliament, after another Nationals MP pledges support for it.

Llew O'Brien is one of the fresher faces in the 45th Parliament, but he has parachuted himself into the political spotlight by confirming he would back the proposal from Nationals Senator Barry O'Sullivan.

Mr O'Brien gave his support on the condition the inquiry investigate discrimination by financial institutions against people with mental health problems.

The Australian, 24 November 2017:

Liberal National Party senator Barry O’Sullivan will move a motion in the Senate next week to establish a powerful probe into the financial services sector, staring down government opposition and criticism from former prime minister John Howard.

Senator O’Sullivan yesterday hit back at Mr Howard’s labelling of his proposed bank probe as “rampant socialism” after circulating a draft bill to establish a commission of inquiry into the banking sector.

Tuesday 8 August 2017

"Which Bank?" Allegations of est. 1,610 suspect financial transactions possibly involving money laundering or terrorism funding

Calls for a royal commission into banks and banking practices will probably grow louder.......

ABC News, 3 August 2017:

The Australian Transactions Reports & Analysis Centre (AUSTRAC) today launched civil proceedings in the Federal Court alleging that the Commonwealth Bank failed to comply with the law on 53,700 occasions.

The allegations follow an AUSTRAC investigation into the CBA's use of intelligent deposit machines (IDMs) between November 2012 and September 2015.

The maximum penalty for each of the 53,700 contraventions is up to $18 million.

The potentially massive penalties would dwarf a $45-million fine imposed on Tabcorp earlier this year for failing to comply with anti money laundering and terror financing laws…..

The transactions in question had a total value of around $624.7 million.

ABC News, 7 August 2017:

The Commonwealth's allegations about the extent of the breakdown of CBA's legal obligations are breathtaking.

Reading between the lines in the statement of claim, it would appear Australian Federal Police (AFP) investigating at least four money-laundering syndicates discovered Austrac had no transaction records on those they had under surveillance.

In August 2015, CBA provided authorities with details on two of those missing transactions. Clearly, that caused panic within the bank. For just a month later, it sent Austrac details of a further 53,504 transactions dating back three years where $10,000 or more had taken place.

At least 1,604 of those late filings related to criminal gangs. Even more alarming, a further six filings related to five customers the bank itself had identified as posing a terrorism risk. But, incredibly, it didn't report them.

That is not the end of it. According to the statement of claim, the bank continued to facilitate transactions for drug syndicates even after being alerted by the AFP.

Even as late as January this year, 18 months after the breaches were first discovered, it is accused of failing to report suspicious transfers totalling $320,000 over five days.

The calamity is being sheeted home to the installation of whiz-bang new machines, intelligent deposit machines.

These accept cash or shares, count the money and then deposit it into a CBA account. From there, it can be sent almost instantly to anywhere in the world. And the neat thing, from a criminal or terrorist viewpoint, is that you do not have to be a CBA customer to do it.

Not only that, they would take up to $20,000 at a time. The machines may be intelligent but, sadly, no-one at the bank seemed to give a second thought to the reporting duties, either around the $10,000 limit or to look out for "structured" transactions — those attempting to fly just under the radar with slightly smaller amounts.

When they were first introduced in 2012, they proved popular. Almost $90 million went through in the first six months. That has since risen to around $1 billion a month.

As the debacle unfolded last week, the other banks — all of which have introduced similar machines — were keen to distance themselves from the drama, even if ANZ boss Shayne Elliott lamented that all would suffer.

Each said they had removed "non-compliant machines", whatever that means. For it is not the machines that are at fault. It is the oversight that has failed.

Interestingly, each of the CBA's three main rivals were keen to emphasise that their machines would accept a maximum of $5,000. In effect, that means no single transaction would ever come close to the reporting limit, thereby letting them off the hook……

The odds on a royal commission have now shortened dramatically, for the Turnbull Government's resolve to resist one must now be spent.

Not only that, the banks have lost any moral ground they may have thought they had in opposing the Federal Government levy.

If recent history is anything to go by, the bank and its leaders merely will attempt to pretend it is all a media beat-up and it is business as usual.

There will be the usual contrite statements, the promises of improving systems to ensure there is no repeat, an internal inquiry no less, most likely as early as this week when Mr Narev unveils a $9.8 billion profit.

This time, however, the attack will not be so simply to parry. It is not an angry but disorganised customer base baying for blood. These are issues of national security and the prospect of a concerted legal assault by the Australian Government solicitor.

Hold the bonuses? The fallout is likely to be somewhat larger.

Commonwealth Bank, ASX announcement, 4 August 2017:

Commonwealth Bank response to media reports regarding AUSTRAC civil proceedings

Friday, 4 August 2017 (Sydney):

Commonwealth Bank of Australia notes the media coverage of the civil penalty proceedings initiated yesterday by AUSTRAC for alleged non-compliance with the Anti-Money Laundering and Counter-Terrorism Finance Act 2006. The matter is subject to court proceedings. We are currently reviewing AUSTRAC’s claim and will file a statement of defence. We will keep the market informed of any updates in compliance with our disclosure obligations.

Labels:

banks and bankers,

royal commission

Thursday 13 July 2017

Tendered exhibits about child sexual abuse in Catholic institutions investigated by Catholic Church Insurance (CCI) and the Society of St Gerard Majella published by Royal Commission

Royal Commission into Institutional Responses to Child Sexual Abuse, media release:

10 July, 2017

The Royal Commission has published documents relating to Catholic Church Insurance (CCI) and the Society of St Gerard Majella that were tendered during the public hearing into Catholic Church authorities in Australia (Case Study 50).

The public hearing was held in Sydney in February 2017.

The CCI documents relate to investigations conducted by CCI into child sexual abuse claims to establish whether an insured Catholic Church authority had prior knowledge of an alleged perpetrator’s propensity to abuse.

The Royal Commission has published CCI documents relating to 22 alleged perpetrators.

The Society of St Gerard Majella was a Catholic religious institute founded in the 1960s. It was suppressed by the Vatican at the request of the Bishop of Parramatta in 1996, which had the effect of closing down the Society.

Please note that the documents in both exhibits (Exhibit 50-0012 and Exhibit 50-0013) contain redactions of names and identifying information that are subject to directions not to publish.

Visit Case Study 50 and go to exhibits to find the documents.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Royal Commission Analysis of claims of child sexual abuse made with respect to Catholic Church institutions in Australia, June 2017.

Friday 30 June 2017

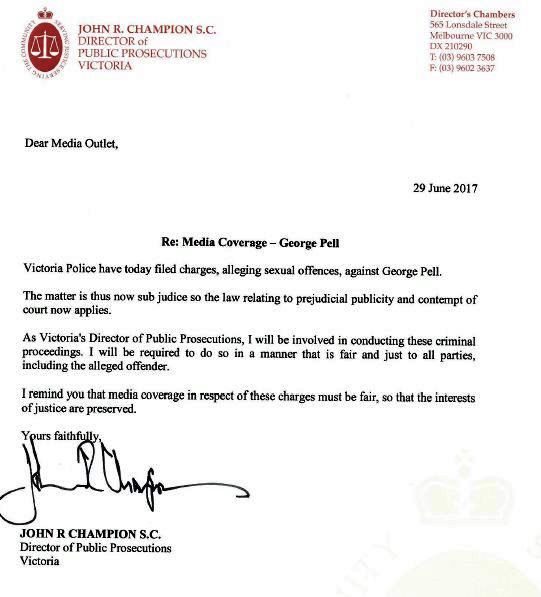

Update on Australian Cardinal George Pell: charged with mulitiple sexual offences by Victoria Police

Australian Cardinal George Pell, currently living and working in the Vatican, has been charged on summons by Victoria Police with multiple serious historical sexual offences.

The Australian, 29 June 2017:WATCH the whole press conference where @VictoriaPolice announce Cardinal George Pell has been charged with historical sex offences. pic.twitter.com/kiyGv691Q9— ABC News (@abcnews) June 29, 2017

No-one with credibility in the church underestimates the damage caused by clergy abuse, a stain that could still be decades from being rubbed out.

This is the broader challenge facing the Catholic hierarchy.

An 18-month or two year court battle, regardless of whether or not it finds in favour of Pell, will mark more lost time as the church tries to deal with the aftermath of the abuse scandal.

This negative publicity will be compounded by the ongoing reporting of the child sex abuse royal commission, which is still to hand down major reports into the Melbourne and Ballarat case studies.

Pell, being the divisive figure that he is and has been, is receiving support from many of his senior peers but the church is also home to many who believe the institution can only move forward when it sees the cardinal’s back.

Perhaps a fairer perspective is to withhold judgment until the evidence is presented to the court.

It’s often been said but it is worth repeating; the least the victims deserve is the truth, which has been in short supply for too long.

BACKGROUND

Further to Cardinal George Pell’s evidence given to the Royal Commission into Institutional Responses to Child Sexual Abuse1.

The Australian, 16 May 2017:

<

Lawyers representing George Pell have demanded an apology and retraction from Fairfax and The Guardian over articles repeating child sexual abuse allegations made in a new book described by the cardinal as a “character assassination”.

The legal demands were sent to the media outlets at the weekend after a book made a series of allegations against Cardinal Pell over his role in the sex abuse scandal engulfing the Catholic Church…..

MUP chief executive Louise Adler said the publishing house had received letters from Cardinal Pell’s representatives but no legal action had been threatened.

Crikey, 23 May 2017:

George Pell, both the man and his troubles with the Royal Commission into Institutional Responses to Child Sexual Abuse, might be affecting Australia’s representation in the highest council of the Catholic Church, the College of Cardinals — which elects the Pope — given Sydney (and Melbourne) once more missed out in the latest, very eclectic list from Pope Francis.

Seven News, 20 June 2017:

Chief Commissioner Graham Ashton told ABC radio Cardinal Pell's lawyers will be told first, once a decision is made whether to charge him.

"A decision is imminent," Mr Ashton told ABC this morning.

"There is a great deal of public interest in it [the George Pell case].

"We'll get something out soon."

It's the third time Mr Ashton has promised an "imminent" decision on the allegations after police got advice from the state's Director of Public Prosecutions on May 16.

On May 18 Mr Ashton said the process wouldn't take too long, and a decision would be reached within a few weeks.

A week later he told 3AW the decision was not too far off.

"The decision is imminent on that," Mr Ashton said on May 25.

On June 1 he described it as "fairly imminent".

The Australian, 24 June 2017:

Those closest to George Pell are increasingly pessimistic about his chances of avoiding charges over historical child sex abuse allegations.

The Weekend Australian has been told by multiple sources that — despite his vehement denial of wrongdoing — there is a growing resignation that charges will almost certainly be laid, plunging the church into what would be an unprecedented scandal.

The Rule Of Law Institute Of Australia Incorporated (a somewhat obscure not-for-profit organisation registered in June 2010) also offered its mite on the subject in The Australian on 25 June 2017:

Victoria Police has been warned not to charge Cardinal George Pell over alleged child sexual abuse to clear the air, or to stage a show trial in response to intense public interest and anger over clerical sex abuse in general.

Lawyer Robin Speed, president of the Rule of Law Institute of Australia said prosecutors should act against Cardinal Pell only if they were fully satisfied about the quality of the evidence.

“They should not act in response to the baying of a section of the mob,’’ he said…..

Mr Speed said that if the cardinal was charged and found innocent the drawn out conduct of the investigation over two years could warrant a judicial inquiry.

Footnote

1. Cardinal George Pell gave evidence from 29 February 2016 by video link from Rome concerning Case Study 35: Catholic Archdiocese of Melbourne and Case Study 28: Catholic Church authorities in Ballarat. Reports on Case Study 28 (Catholic Church authorities in Ballarat) and Case Study 35 (Catholic Archdiocese of Melbourne) are yet to be published.

Labels:

child sexual abuse,

investigation,

law,

local courts,

religion,

royal commission

Tuesday 11 April 2017

Royal Commission into Institutional Responses to Child Sexual Abuse comes to an end after three and a half years of hearings

The long journey was harrowing for the victims, heartbreaking for their families and friends. It shocked and appalled a nation which up to that point had never turned to face the true scale of child sexual abuse within religious and state institutions.

With 57 case studies completed, an est. 5,000 alleged perpetrators revealed in previously reported/unreported claims of child sexual abuse, more than 6,500 victims or their representatives interviewed and 1,950 referrals to authorities (including police), this journey has completed its first stage.

What comes next will depend in some measure on the resolve of ordinary Australians to continue to publicly hold federal and state governments as well as religious administrations to the undertakings they have given to the Royal Commission, to completely eradicate child sexual abuse within their institutions and cease protecting the criminals in their ranks who perpetrate such abuse.

Case Study 57

The Hon Justice Peter McClellan AM

Chair, Royal Commission into Institutional Responses to Child Sexual Abuse

Today brings the last of our case study hearings to an end. There is an unfinished matter which has been delayed because a trial is listed in April. We will consider the future course of that matter at a directions hearing at a later date.

As I indicated on Monday we have been conducting public hearings since September 2013. The hearings have heard from many survivors and have allowed the intensive scrutiny of the actions of individuals within institutions. We have also looked at how institutions were managed at the time of the abuse and how, once the abuse became known, the institution responded. We have been told by many people that the public hearings have had a profound effect on the community’s understanding of the nature and impact of the sexual abuse of children in Australia. This is primarily due to the courage and determination of the survivors who have given evidence. Although a relatively small number they have given voice to the suffering of the tens of thousands who have been abused in an institutional context in Australia.

There are many people who must be acknowledged for their contribution to our program of public hearings. The starting point for a public hearing is the

work undertaken by the Commission’s legal and investigation teams. They have worked with great dedication, and often under great stress and for long days to bring together witnesses and documents for the hearing. We thank each of them for their efforts on the many case studies. We have also valued the contribution from our policy staff who, of course, have a fundamental role in the preparation of our final report.

The technical expertise required to ensure our hearings are available to the internet has been complex. Without question this process has contributed greatly to the community’s knowledge of the work we have been doing. Going forward I suggest the usual position should be for the live streaming of the hearings of any public inquiry. Our thanks go to the team of technicians and operators who have made this possible.

The Royal Commission has travelled across the entire country to conduct public hearings. This has been a challenging and, at times, complex logistical task. The Commissioners are grateful to the staff who have contributed to the smooth running of our public hearing program.

We owe a special debt to the dedicated team of stenographers who have produced our transcripts. A real time transcript is a valuable tool for a Royal Commission but we appreciate it imposes considerable burdens on those who prepare it. We greatly appreciate their efforts. They have our thanks.

The Commissioners thanks are also due to the many people in institutions who have assisted by producing documents, identifying witnesses, and in almost all cases, participating in our public hearings with the purpose of assisting the Commissioners to understand the story from their institution.

For the care and support that our counselling team and community engagement staff have given to witnesses appearing before the Commission, especially survivors, the Commissioners express our gratitude. Their task has been complex but of fundamental importance to ensure that a survivor’s engagement is both positive, but more importantly, safe. These teams have the admiration of all the Commissioners for the skill and care they give to their task.

We also express today our gratitude to the media for the comprehensive and effective reporting of our work. Television has provided live coverage of the opening of many hearings. I appreciate the limits of column space and the demands of deadlines. But within these limits many media outlets have given prime news or current affairs space to our work. Both the Commissioners and, I am sure, the entire community are grateful for their efforts.

Our thanks also go to all counsel, both those who have assisted the Commission and those who have appeared for survivors and institutions. But above all our thanks are due to Gail Furness. She came to us with the insight gained from an inquiry in the child protection area. She has long ago mastered the inquiry process and the management of a public hearing. But beyond those matters Gail has remarkable abilities of forensic analysis and advocacy. Few people would appreciate the enormous burdens she has carried throughout the hearings. Scrupulously fair, without Gail’s efforts we simply could not have completed our task.

Finally we extend both our recognition and thanks to survivors who gave evidence. Without them our public hearings would be a hollow attempt to tell their story. Without them the realities of child sexual abuse and the extent of institutional failure could not be recognised. Given with difficulty but great courage the telling of each of your personal stories has enabled the Commission and the general community to gain a real understanding of your suffering. It will assist the Royal Commission in the preparation of recommendations in our final report to which we now must turn.

Monday 13 February 2017

The shocking truth about historic institutional child sexual abuse in Australia

A Child’s Morning Prayer

Lord, I awake and see your light,

For You have kept me through the night,

To You I lift my hands and pray,

Keep me from sin throughout this day,

And if I die before it's done,

Save me through Jesus Christ, Your Son.

For You have kept me through the night,

To You I lift my hands and pray,

Keep me from sin throughout this day,

And if I die before it's done,

Save me through Jesus Christ, Your Son.

Amen.

A Child’s

Night Prayer

Angel

of God, my Guardian dear,

to whom

His love commits me here,

ever

this night be at my side,

to

light and guard,

to rule

and guide.

Amen

Origin unknown

The Commonwealth

of Australia Royal Commission into Institutional Responses to Child

Sexual Abuse held its first public hearing in Sydney from Monday 16 to Thursday 19

September 2013. The Royal Commission's first

public hearing into the Catholic Church in Australia and child sexual abuse

began on Monday, 9 December 2013 and multiple hearings relating to Catholic institutions and specific clergy followed over the next four years.

1. This is the Royal Commission’s 50th

public hearing…..

7. It was plain that hearings were

needed to examine the responses of faith-based institutions, given that, as at

the end of 2016, 60% of survivors attending a private session reported abuse in

those institutions. Of those survivors, nearly two thirds reported abuse in

Catholic institutions. While the percentage has varied over time, at present

over 37% of all private session attendees reported sexual abuse in a Catholic

institution. Consequently Catholic institutions were a key part of the Royal

Commission’s public hearings. …….

26. Between January 1980 and February

2015, 4,444 people alleged incidents of child sexual abuse made to 93 Catholic

Church authorities. These claims related to over 1000 separate institutions.

27. The claims survey sought

information about the people who made claims of child sexual abuse. Where the

gender of people making a claim was reported, 78% were male and 22% were

female. Of those people who made claims of child sexual abuse received by

religious orders with only religious brother members, 97% were male.

28. The average age of people who made

claims of child sexual abuse, at the time of the alleged abuse, was 10.5 for

girls and 11.6 for boys. The average time between the alleged abuse and the

date a claim was made was 33 years.

29. The claims survey sought

information about alleged perpetrators of child sexual abuse. A total of 1,880

alleged perpetrators were identified in claims of child sexual abuse. Over 500

unknown people were identified as alleged perpetrators. It cannot be determined

whether any of those people whose identities are unknown were identified by

another claimant in a separate claim.

30. Of the 1,880 identified alleged

perpetrators:

a. 597 or 32% were religious brothers

b. 572 or 30% were priests

c. 543 or 29% were lay people

d. 96 or 5% were religious sisters.

31. Of all alleged perpetrators, 90%

were male and 10% were female.

32. The Royal Commission surveyed 75

Catholic Church authorities with priest members, including archdioceses,

dioceses and religious orders about the number of their members who ministered

in Australia between 1 January 1950 and 31 December 2010. Ten Catholic

religious orders with religious brother or sister members provided the same

information about their members.

33. This information, when analysed in

conjunction with the claims data, enabled calculation of the proportion of

priests and religious brother and sister members of these Catholic Church

authorities who ministered in this period and who were alleged perpetrators.

34. Of priests from the 75 Catholic

Church authorities with priest members surveyed, who ministered in Australia

between 1950 and 2010, 7.9% of diocesan priests were alleged perpetrators and

5.7% of religious priests were alleged perpetrators. Overall, 7% of priests

were alleged perpetrators.

35. The Archdiocese of Adelaide and

the Dominican Friars had the lowest overall proportion of priests who

ministered in the period 1950 to 2010 and were alleged perpetrators, at 2.4%

and 2.1% respectively.

36. The following five archdioceses or

dioceses with priest members which had the highest overall proportion of

priests who ministered in the period 1950 to 2010 and who were alleged perpetrators:

a. 11.7% of priests from the Diocese

of Wollongong were alleged perpetrators

b. 13.9% of priests from the Diocese

of Lismore were alleged perpetrators

c. 14.1% of priests from the Diocese

of Port Pirie were alleged perpetrators

d. 14.7% of priests from the Diocese

of Sandhurst were alleged perpetrators

e. 15.1% of priests from the Diocese

of Sale were alleged perpetrators.

37. The following five religious

orders with priest members had the highest overall proportion of priests who

ministered in the period 1950 to 2010 and who were alleged perpetrators:

a. 8.0% of priests from the

Vincentians – The Congregation of the Mission were alleged perpetrators

b. 13.7% of priests from the

Pallottines – Society of the Catholic Apostolate were alleged perpetrators

d. 17.2% of priests from the Salesians

of Don Bosco were alleged perpetrators

e. 21.5% of priests from the

Benedictine Community of New Norcia were alleged perpetrators.

38. In relation to religious orders

with religious brother and sister members, the Sisters of St Joseph of the

Sacred Heart and the Sisters of Mercy (Brisbane) had the lowest overall

proportions of members who were alleged perpetrators, at 0.6% and 0.3%

respectively.

39. The following five religious

orders with only religious brother members had the highest overall proportion

of religious brothers who ministered in the period 1950 to 2010 and who were

alleged perpetrators:

a. 13.8% of De La Salle Brothers were

alleged perpetrators

b. 20.4% of Marist Brothers were

alleged perpetrators

c. 21.9% of Salesians of Don Bosco

brothers were alleged perpetrators

d. 22.0% of Christian Brothers were

alleged perpetrators

e. 40.4% of St John of God Brothers

were alleged perpetrators.

c.

13.9% of priests from the Marist Fathers – Society of Mary were alleged

perpetrators, as distinct from the Marist Brothers.

NOTE:

The St. John of God Brothers were

established in Australia in the 1940s by eight men,

six of whom were believed to be paedophiles. Brothers

Kilian Herbert and Laurence Hartley arrived in Sydney from Ireland on 11 August

1947 to head this small group.

Previous North Coast Voices posts on child sexual abuse can be found here.

News.com.au, 6 February 2017:

A brief of evidence concerning historical claims of sexual abuse at the hands of Cardinal George Pell has been delivered to prosecutors for consideration.

Victoria Police confirmed with AAP on Monday night that investigators had delivered the brief to the Office of Public Prosecutions.

It's a significant development in the case since three police travelled to Rome in October to speak with the former Ballarat priest and Melbourne archbishop.

Cardinal Pell now resides full-time at the Vatican. He cited ill-health as a reason he could not travel back to Australia to give evidence in last year's royal commission into institutional responses to child sexual abuse, appearing instead via video link.

Allegations emerged in 2015 from two men who said they were groped as children by Cardinal Pell when he was a priest in Ballarat during the 1970s.

Another man claimed he saw the priest expose himself to young boys in the late 1980s.

Cardinal Pell previously released a statement rejecting "all and every allegation of sexual abuse" and would continue co-operating with Victoria Police until the investigation was finalised.

The

Northern Star, 7

February 2017:

WEDNESDAY 4.30pm: NEARLY

14% of Lismore's most experienced Catholic priests were accused of sexually

abusing children by 2010 but the diocese's spokesman, the Most Reverend

Geoffrey Jarrett, has reserved comment.

Between 52 and 64

priests have served in the Diocese of Lismore in each decade since 1950, with

129 priests having served in the area by 2010, detailed data presented to the

Royal Commission into Institutional Responses to Child Sexual Abuse has shown.

Some 18 of those

priests, or 13.9%, have been accused of sexually abusing children throughout

their careers, marking Lismore as one of the nation's top five worst dioceses

for child sex accusations against the Church.

Too soon to comment:

Diocese of Lismore

But Apostolic

Administrator of the Diocese Bishop Jarrett, standing in while Bishop-elect

Father Gregory Homeming prepares for his ordination, said it was too early to

comment publicly on findings.

"My response is

that we are in the early days of the Royal Commission's present three week

hearing, and until it completes its investigation, it would be premature to

comment on the first release of statistics," Bishop Jarrett said via email

to The Northern Star.

"We would expect to

have a fuller picture and a wider range of issues as time goes on and I will be

available for comment at the end of the hearing."

Labels:

Australian society,

child sexual abuse,

crime,

law,

religion,

royal commission

Thursday 27 October 2016

Are We Any Closer To Having A Banking Royal Commission?

In Do we need a Royal Commission into the banks? (North

Coast Voices 21st April 2016) I wrote: “What is very obvious is that

there is a need to shine a very strong light on the banking/ finance industry

in order to force the changes that are required to make it fairer and more

responsive to customer needs. Moreover

there is an ongoing need to ensure proper compensation for consumers who have

been hurt by unscrupulous behaviour over recent years. And the “bad apples” in the sector need to be

identified and removed. This would lead

to a marked improvement in public confidence in the banking/finance system.”

What has changed in the

six months since then?

Very little of substance. The returned Coalition Government continues

to reject holding a Royal Commission into the banking/finance system while the

ALP Opposition and the Greens continue to call for one. However, the Government has obviously been

feeling under pressure on this matter. Although it still continues to rail

contemptuously about the Opposition’s “populist” Royal Commission policy, it

has abandoned its “do nothing” stance to take some limited action which it

obviously hopes will neutralise Labor’s calls.

The first of these was a

brief inquiry conducted by the ten member House of Representatives Standing

Committee on Economics on October 4th -6th. (The composition of this Committee is: five

Liberal MPs, one National, three Labor and one Green.) It was called by Prime

Minister Turnbull after the major banks failed to pass on in full the Reserve

Bank’s 0.25% rate cut to mortgage holders. Mr Turnbull said that it was an

opportunity for the banks to explain how they deal with their customers, and why

they make interest rate decisions and be open and accountable about it. It is

significant that it was interest rates, not the many other really appalling

actions of the banks over many years that produced this tepid inquiry.

The CEOs of the four

major banks (Commonwealth, ANZ, National and Westpac) each spent three hours

answering questions on matters such as bank policies, past mistakes, how these

had been remedied and the action taken on those responsible for mistakes and

illegal activities.

Some committee members

were concerned about the very limited time available (around 20 minutes with

each CEO for each member) which led to the question of whether CEOs would be willing

to return for a further session. Deputy Chair of the Committee Matt

Thistlethwaite (Labor) remarked that the twenty minutes he would be getting was

farcical because he had two days’ worth of questions to put to the CEOs. Apparently those asked about returning

expressed a willingness to do so – quite understandably given that this

“inquiry” was obviously very preferable to a Royal Commission.

All CEOs were contrite

about their banks’ past performances but claimed that the problems had been

investigated (or were still being reviewed) and were (or would be) fixed.

Obviously they believe that the Australian community should accept promises that

the banks will put their own houses in order – something they have obviously

not felt compelled to do in the past. The fact that many (if not most) of those

responsible for the bad behaviour are still employed by the banks raises

serious questions about bank culture and doubts about the banks’ commitment to

improvement. There are many other issues

which need more than vague promises about “doing better in future”. These include the lack of transparency, the

lack of competition in the sector, the incentives which have encouraged

predatory and illegal behaviour, and the inflated salaries rewarding the CEOs

who are ultimately responsible for the culture and the bad behaviour.

The inadequacy of this

brief and tepid inquiry was obvious even to the Government. Although still anxious to shield the banks

from a really sweeping and effective inquiry, it has recently announced a

further inquiry – a banking tribunal which it is claimed will be a low-cost way

for victims of the banks to seek justice.

The Opposition has

predictably seen it as yet another way to avoid a Royal Commission with Shadow

Financial Services Minister Katy Gallagher claiming it was “all pre-determined and

pre-agreed with the banks.”

What must be worrying

the Government is that there is considerable public support for a Royal

Commission and the paltry measures so far undertaken by the Government are

unlikely to weaken this support. A national poll conducted by the Australia

Institute in the second half of September found 68% supported a Royal

Commission or similar inquiry and only 16% opposed it. Furthermore 52% of those surveyed believed

that Prime Minister Turnbull was protecting the banks in refusing to call a

Royal Commission. Only 21% disagreed.

This issue is not going

to go away. The more the Government tries to defuse the situation with ad hoc

measures such as the recent ineffective Parliamentary Committee inquiry and the

promise of a banking tribunal, the more it is going to be seen as being out of

touch with a very substantial part of the electorate.

Hildegard

Northern

Rivers

GuestSpeak is a feature of North Coast Voices allowing Northern Rivers residents to make satirical or serious comment on issues that concern them. Posts of 250-300 words or less can be submitted to ncvguestspeak AT gmail.com.au for consideration. Longer posts will be considered on topical subjects.

Subscribe to:

Posts (Atom)