Saturday 28 May 2016

Quotes of the Week

Policy decisions taken since the 2016-17 Budget have worsened the underlying cash balance by around $1.8 million in 2016-17…..

[Australian Treasury and Dept. of Finance, Pre-election Economic and Fiscal Outlook 2016]

"F--- them. If you care about books, don't vote Liberal."

[Author Richard Flanagan at the Australian Book Industry Awards, quoted in The Sydney Morning Herald, 20 May 2016]

Joke of the Week

A tired old swaggie is trudging along one of the dusty backroads, back o' Bourke. She's just gorn 2 o'clock, about 110 degrees Fahrenheit in the shade, the blowies are shocking and his swag feels like a bag of wet wheat. His back aches, the sweat is pouring off him and the soles of his one pair of boots have more holes than leather.

And now, from way behind him in the distance he sees a ball of dust approaching along the road at great speed. The swaggie stops, lays down the swag and wipes his brow as the car pulls to a halt beside him.

It's a brand new ute driven by the biggest property owner in the district – the only bastard in two hundred mile who smokes cigars. He winds down the passenger-side window as the swaggie savours the sudden lovely cool of the ute's air-conditioning running at full blast.

"Hop in, mate," says the filthy-rich Cockie, "Too hot to walk. I'l give yer a lift."

The swaggie pauses, slowly looks the car up and down, then turns his gaze on the driver and says, "Nah. Open your own bloody gates."

[Peter Fitzsimmons, The Sydney Morning Herald, 15 May 2016]

Friday 27 May 2016

Euen denies his unrealistic plan for a "Yamba Super-Port" includes a coal loader or bauxite moving through the port

An short anonymous online snippet under the pen name "Maclean" in The Northern Star on 14 April 2016 included this photograph of Desmond John Thomas Euen (far left) with the Australian Deputy-Prime Minister and MP for New England Barnaby Joyce:

The photograph appears to have been taken at one of the Lismore bowling clubs on an unspecified date and the published snippet (possibly penned by Mr. Euen himself) contained no real details of what the dour former Queensland truck driver told Barnaby Joyce about his personal plan for the small Port of Yamba.

However, a local reader told me on 25 May 2016 that when contacted Des Euen is once again "emphatically" denying there will be any facilities for coal loading in his plan for Yamba and that coal and bauxite will not be going through the port.

The photograph appears to have been taken at one of the Lismore bowling clubs on an unspecified date and the published snippet (possibly penned by Mr. Euen himself) contained no real details of what the dour former Queensland truck driver told Barnaby Joyce about his personal plan for the small Port of Yamba.

However, a local reader told me on 25 May 2016 that when contacted Des Euen is once again "emphatically" denying there will be any facilities for coal loading in his plan for Yamba and that coal and bauxite will not be going through the port.

He claimed to this local reader that there had never been any plans for a coal loader or for bauxite to move through the port.

Des apparently said “no coal loading facilities”, “no bauxite loading facilities” and “that has always been the case.”

But only one week before his denial at least one version of the invitation to the so-called "summit" in Casino posted online by Euen included the statement: ”The dual capacity of Yamba Port and Pacific West Rail to provide a viable alternative route for the carriage of mineral resources emanating from Northern NSW and the lower section of the Surat Basin".

On 25 May that 4 May 2014 dot point was also still up on the AID Australia Pty Ltd website:

In his presentation to Moree Plains Shire Council on 12 June 2014 Euen is clearly expecting that his proposed rail network will potentially carry ore from the Muswellbrook, Glen Innes and Narromine rail heads to the Port of Yamba:

On 9 February 2015 and again on 26 May 2016 this dot point was sighted by North Coast Voices on the AID Australia Pty Ltd website:

Readers have been tracking some of the text changes Euen makes to the AID Australia website and are of the opinion that reference to a coal port found at http://www.aid-australia.com.au/competitive-edge/ is no longer directly accessible from the 'company' website homepage and is no longer included in the AID Australia's A “Key” Nation Building Infrastructure Plan Summit invitation.

Reference to the possibility that bauxite would be loaded from this new Yamba Super-Port can be found on the Australian Stock Exchange website where a gullible Queensland Bauxite Limited told the world it had been in talks with Mr. Euen.

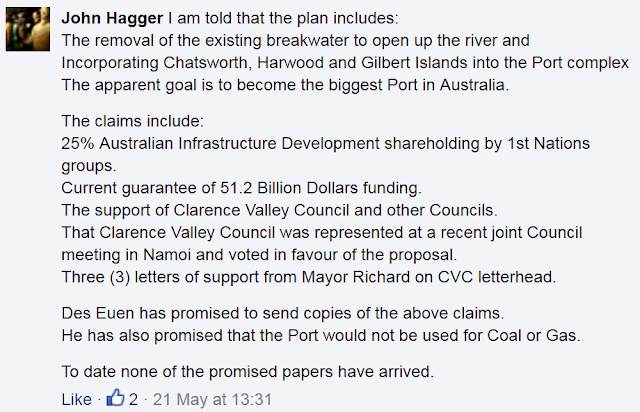

Des Euen has also given similar assurances (no coal and no gas) to a member of the Clarence Forum:

Des Euen has also given similar assurances (no coal and no gas) to a member of the Clarence Forum:

NOTE: Mayor Richie Willaimson has again denied he supports Euen's port expansion plan.

To be frank, to date in the Lower Clarence there is scant belief in Des Euen's facile assurances about his personal plans for Yamba.

Plans which he has never deigned to publicly present and explain to the Yamba community - perhaps because he is afraid that his grandiose phantasy would be blown out of the water by local knowledge of the Clarence River, its estuary, physical environment and coastal approaches.

Plans which he has never deigned to publicly present and explain to the Yamba community - perhaps because he is afraid that his grandiose phantasy would be blown out of the water by local knowledge of the Clarence River, its estuary, physical environment and coastal approaches.

Labels:

Clarence River,

coal,

environmental vandalism,

gas industry,

mining,

Port of Yamba

Journalist Paul Bongiorno on the subject of Tony Abbott's comeback ambitions in 2016

ABC NEWS: MP for Warringah Tony Abbott’s 2016 federal election campaign launch

The New Daily, 16 May 2016:

Just ask yourself this: what other backbench member of parliament could attract all the TV networks, extensive radio coverage and print reporters to their local campaign launch?

Only a deposed prime minister keen to keep his name up in lights and intent on a comeback would be capable of the feat.

Tony Abbott’s Warringah launch had all the trappings of a national event. In fact, it had more razzamatazz than Julia Gillard’s 2010 effort, complete with a giant national flag back drop, professional placards and rows of blue t-shirted supporters.

It was followed with extensive interviews on Sky TV and with high-rating Sydney shock jock Alan Jones. And he is not up to mischief?

It is a free country and he successfully sought Liberal endorsement fair and square. But just as Malcolm Turnbull didn’t hang around in politics to be anything other than Prime Minister, it is surely not beyond the pale to ask why Tony is clinging to his parliamentary career. A lack of imagination doesn’t cut it. To serve the people of his electorate and the nation sounds, well, self-serving.

This is where the game of politics, the rules of engagement and appearances have to be well understood. Mr Abbott has assured his sympathetic media interrogators his party would never turn to him again as leader. His former chief of staff Peta Credlin scotched that one. That’s what he may be thinking now, she says, but experience tells us there’s no such thing as never ever.

Especially as a significant number of Liberals both in and out of the parliament are beginning to worry that Mr Turnbull is just not the politician he needs to be to maximise the government’s position either in the election, or if he should just win it, after the poll.

In fact there is a belief – more a shuddering fear – that the Coalition could be left with a bare majority at best.

“Anything under 80 seats spells doom for Malcolm,” was the view of one disconsolate Liberal MP. Seventy-six are needed to form government.

If perceptions of dithering and drift continue, and the government’s standing worsens, the precedent is set for a coup…..

Thursday 26 May 2016

Former Australian Treasurer Joe Hockey's 'gift' to all property owners across the nation

Australian Financial Review, 13 August 2015

The Australian, 19 May 2016:

The current mess was created when former treasurer Joe Hockey caved into pressures to curb Chinese investment in Australian residential property in 2015. In the process, the treasurer was convinced by the Australian Taxation Office to widen the net to cover local residents.

Parliament was being bombarded with tax legislation at the time and the Canberra politicians did not pick up what the ATO had done.

So, fasten your seats belts for a horror commentary.

I was alerted to the position by one of Australia’s top commercial/tax barristers, John Fickling of WA. I am using many of Fickling’s words in describing what is about to happen.

If you purchase a property worth $2m or more on or after July 1 2016, you will be required to withhold 10 per cent of the purchase price and remit it to the ATO UNLESS the vendor is able to provide a special purpose tax resident’s “clearance certificate” from the ATO. It does not matter if the vendors were born in Australia and have lived all their lives in Australia — unless they have that clearance certificate, they are classed as a foreigner and the buyer must send 10 per cent of the purchase price to the tax office.

In case you think I’m kidding, read the ATO’s exact words: “A vendor who sells the following assets is also a relevant foreign resident, even if they are an Australian resident for other tax purposes.

The definition of property is very wide and includes leaseholds but does not include stock exchange investments. A purchaser who does not receive a “clearance certificate” from the vendor and does not send 10 per cent of the purchase price off to the ATO will still be liable to pay that 10 per cent to the ATO plus, almost certainly, will have to pay severe additional penalties and interest. The economics of buying the property will be severely damaged.

Fickling says all real estate agents selling $2m plus properties should be considering how this new regime will impact on their business and what will be the contractual consequences under the different scenarios that could play out.

For example, banks and other financiers may be affected where their secured debt exceeds 90 per cent of the value of the selling price. In a situation where the owner is being forced to sell, the banks will be better to take possession and sell themselves rather than being caught in the “tax clearance” delays.

To be fair, in the vast majority of cases local resident vendors will have no problem obtaining a “clearance certificate”.

However, for locals it might increase their risk of a tax audit and there are clear hazards for property sellers who:

Have not filed tax returns for many years;

Have filed tax returns, which would indicate they could not afford such a property;

Are selling their residential house at the same time as their neighbours to a single developer, which may give rise to a profit making scheme (such that the principal residence capital gains tax exemption may not apply to the value uplift generated by selling the properties together); or

Where the ATO has gathered information that indicates the vendor is in the business of developing property, which means that the principal residence capital gains tax exemption may not apply.

Fickling says in extreme cases action could potentially be taken by the ATO prior to the sale, to freeze the transaction.

Those who see any of the above as dangers might consider selling in a hurry (before July 1), so there might be some property bargains for buyers in coming weeks.

It’s also important to note that the $2m is “hard-coded” into the legislation, so, as property prices increase, more vendors will be caught. Over time, the ATO may shift their audit target identification processes to $2m-plus property vendors and away from other areas.

Additionally, if the vendor has a tax debt, the application for a “clearance certificate” may in some circumstances involve the ATO seeking to recover some or all of that tax debt from the purchaser by way of a garnishee notice.

At this point, it is worth noting that we are giving the Australian Taxation Office another weapon to recover tax legitimately owed and that is a good thing for society.

The great danger is the complexity created and that currently the tax office is badly run and is operating outside the law in key small business areas. It knows it can’t be challenged because of the cost of court cases.

Meanwhile, the legislation is yet another blow being aimed at Chinese and other Asian investors in property. These blows have come separately and each one has had reasonable motivations. But, in combination, they could inflict severe damage to the apartment and other parts of the residential property market.

Chinese and other Asian investors face a Hobson’s choice. They will not enjoy getting a tax clearance but nor will they appreciate the buyer of their property taking 10 per cent off the purchase price.

And if the tax office treats locals illegally, what might they do to foreigners?

Australia desperately needs greater independent supervision of the tax office.

In case readers imagine that high property prices are confined to large metropolitan areas a quick look at realestate.com.au will dispel that view – within the NSW Northern Rivers there are currently 7 properties in Yamba and environs with a sale value of $2 million and over, 4 in the Grafton area, 6 in Kyogle, 9 in the Lismore region, 35 in the Ballina district, 78 in the Byron Bay greater region and 46 in the Tweed local government area.

Labels:

Abbott Government,

ATO,

Federal Election 2016,

housing,

taxation

Australian Federal Election 2016: alleged corruption in Border Force ranks

Prime Minister Malcolm Turnbull

17 May 2015

The Age, 19 May 2016:

A network of Australian border security officials is allegedly working for organised criminals, including drug and tobacco smugglers, in the most serious corruption scandal to ever hit the nation's border agencies.

A Fairfax Media investigation has uncovered multiple cases of alleged corruption involving staff from the Australian Border Force and the Department of Agriculture, along with maritime industry employees with government clearances…..

The allegations come as the government makes a virtue of its strength on border security, with Prime Minister Malcolm Turnbull claiming the opposition "lack the commitment to keep our borders secure".

However, the federal government and customs chiefs, including the nation's top border security official, Michael Pezzullo, have been repeatedly warned over four years in high-level confidential briefings about significant suspected corruption in the Border Force's ranks, especially in NSW.

Evidence, including NSW police briefing notes and testimony from crime figures, suggests that one of the most vital border security facilities, the NSW Customs Examination Facility, has been compromised by corrupt insiders, enabling criminals to import large amounts of drugs and tobacco undetected. Staff at the facility are responsible for searching containers suspected to contain contraband.

A small network of Department of Agriculture officials responsible for clearing imports into Australia have also been assisting and liaising with known drug traffickers for at least the past five years…..

Fairfax Media has delayed reporting on the border corruption scandal for several months at the request of authorities.

In NSW, evidence uncovered by Fairfax Media from multiple sources, including agency officials, government briefing files and figures with underworld ties, implicates Border Force officials in drug and tobacco trafficking, and leaking to the criminal underworld.

Criminal intelligence suggests one officer has been taking kickbacks of hundreds of thousands of dollars from traffickers, while another has been facilitating importations.

Suspected corrupt officers are still operating.

The latest scandal comes three years after a network of corrupt customs officers was identified at Sydney airport and charged by the federal police. At the time, Mr Pezzullo promised sweeping reforms, including many which have been implemented.

Top security and policing officials, along with corruption experts, called for the nation's federal police watchdog, the Australian Commission for Law Enforcement Integrity (ACLEI) to have its budget dramatically increased and said the Australian Border Force had failed to deal with corruption in its ranks.

Leading corruption expert and former senior judge Stephen Charles, QC, said ACLEI – which, with about 20 investigators out of a total of 55 staff, is among the smallest corruption fighting agencies in Australia – was badly outgunned. Mr Charles said Australia needed an anti-corruption agency with hundreds of staff……

One senior government source said the Australian Border Force was "incapable" of eradicating corruption in its ranks and sometimes dealt with internal integrity issues with departmental sanctions, such as demotion or sacking, rather than by conducting intensive probes that could expose corrupt networks……

Read the full article here.

One senior government source said the Australian Border Force was "incapable" of eradicating corruption in its ranks and sometimes dealt with internal integrity issues with departmental sanctions, such as demotion or sacking, rather than by conducting intensive probes that could expose corrupt networks……

Read the full article here.

* Photograph found at The Sydney Morning Herald

Subscribe to:

Posts (Atom)