Monday 31 July 2017

Why doesn't the Turnbull Government do more to address domestic tax avoidance?

So why is it that the Turnbull Coalition Government, home to more than one millionaire, continues to allow a set of taxation rules which favour those with both wealth and high incomes over those with only average to low incomes and little to no wealth?

According to the Australian Taxation Office (ATO) – now underfunded, undermanned and demoralised – there is an issue with trusts being used for tax avoidance:

We focus on differences between distributable income of a trust and its net [taxable] income which provides opportunities for those receiving the economic benefit of trust distributions to avoid paying tax on them.

In other words; discretionary trusts are used by high-income earners to distribute investment income to beneficiaries on lower marginal tax rates, in the process reducing the overall amount of tax paid and current rules allow income to be diverted to other family members, such as stay-at-home mothers or fathers, or to dependents over the age of 18, such as children at university, college or Tafe.

Australian Finance Minister and Liberal Senator for Western Australia Mathias Cormann characterises proposals to alter taxation rates on trusts to minimise their use as tax avoidance vehicles as a “tax grab”. Well he would wouldn’t he, with so many political mates to defend.

As for collecting existing tax liabilities……

The ability to enforce payment obligations and pursue avoidance schemes has diminished since 2014 when first the Abbott Coalition Government and then later the Turnbull Coalition Government cut ATO staffing numbers.

The Community and Public Sector Union clearly told the Treasurer in 2017 that:

While the public is supportive of tackling corporate tax avoidance to raise revenue for public services, there are limits to what the ATO is able to do due to significant under resourcing. Despite a growing population and increased expectations from the community, ATO ongoing staffing levels have declined. Between 2013-14 and 2015-16, Average Staffing Levels at the ATO fell by over 4,000 or by nearly a quarter. The audit team, responsible for enforcing the tax compliance of individuals and multinational companies, was hit particularly hard by these job cuts. While there was an increase in the 2016-17 Budget, it has not reversed the significant cuts experienced over the last few years.

Given the need for more, not less revenue, these previous cuts seem illogical. According to information provided to Senate Estimates by senior ATO staff, the return on investment over the last decade would be between 1:1 and 6:1, or simply put every dollar invested in ATO staff generates between $1 and $6 in revenue.[1] Some had previously estimated that the cuts could lead to a loss of nearly $1 billion in revenue.[2]

This disconnect between public expectations that tax avoidance should be tackled and what the ATO can actually do must be addressed by the Government. It should commit to an increase in base funding and staffing for the ATO if it is serious about tackling corporate tax avoidance and increasing revenue.

It seems that while the Turnbull Government talks about an ideal egalitarian society where inequality no longer exists, behind the scenes it is nobbling one of the mechanism’s available to government to ensure that there is a level playing field for all those with only earned incomes as well as those with earned incomes plus accumulated wealth.

So when Turnbull & Co announced in May this year that it intends introducing a strong Diverted Profits Tax and establishing a Tax Avoidance Taskforce in the Australian Taxation Office (ATO) one has to wonder if current staffing levels allow full investigation of multinationals operating in Australia or whether the taskforce (which has in fact existed since 2016) will be adequately resourced to look into multinational tax avoidance and the black economy as mooted.

One also has to wonder why in the face of widespread use of negative gearing of investment properties and capital gains tax arrangements to avoid paying an appropriate tax rate, the Turnbull Government also fails to reform the taxation system in these areas.

Oh, I forgot……………

A total of 331 of these 541 properties were reportedly owned by the 123 Coalition MP and Senators1 sitting in the federal parliament in 2015.

NOTE

1. Table 1: 45th Parliament of the Commonwealth of Australia party representation

Source: Australian Electoral Commission (AEC), ‘2016 Federal Election Tally Room’

Pressure mounts on Turnbull and Berejiklian governments to stop Murray-Darling Basin water theft

MEDIA RELEASE

| |

25 July 2017

|

MR/56/17

|

NSW Farmers’ President Derek Schoen’s statement on ABC Four Corners: “Pumping”

“ABC’s Four Corners episode last night raised a number of very distinct issues that all relate to water take in the Murray Darling Basin. One of the issues raised was illegal water take.

The overwhelming majority of farmers and irrigators do the right thing, however, strong regulatory enforcement is needed when it is proven that water has been taken against the rules, or tampering/disabling of metering equipment has occurred. This is theft from all other water users and it should not be tolerated.

Another issue raised on the program was the changes to the rules that were reflected in the Barwon-Darling Water Sharing Plan, finalised in 2012. These rule changes have been the subject of discussion amongst NSW Farmers’ elected representatives during past months and years, and are something that we know causes significant angst amongst all of the water users within that Water Sharing Plan.

Where it is alleged that those rules were changed without true transparency for all water users- NSW Farmers fully supports an investigation into the process by which these rule changes were made. We call for this on the principle that these changes can have a significant impact on all water users, including stock and domestic water rights holders, and downstream users.

These decisions need to be made with full transparency and scientific backing. Rule changes also need to occur through the established processes of the local consultation committee during the appropriate review period. The agricultural community needs complete certainty that this will occur, always.”

| |

Sunday 30 July 2017

Australian Government guide to when it is extinguishing our traditional freedoms, rights and privileges

In 2015 Australian Attorney-General and Liberal Senator for Queensland George Brandis thoughtfully provided voters with a guide to assist them with analysing whether federal legislation rides roughshod over traditional rights, freedoms and privileges.

This guide can be found in the Australian Law Reform Commission Report 129, Traditional Rights and Freedoms— Encroachments by Commonwealth Laws:

The Terms of Reference, provided by the Attorney-General, Senator the Hon George Brandis QC, state that laws that encroach on traditional rights, freedoms and privileges should be understood to refer to laws that:

interfere with freedom of speech;

interfere with freedom of religion;

interfere with freedom of association;

interfere with freedom of movement;

interfere with vested property rights;

retrospectively change legal rights and obligations;

create offences with retrospective application;

alter criminal law practices based on the principle of a fair trial;

reverse or shift the burden of proof;

exclude the right to claim the privilege against self-incrimination;

abrogate client legal privilege;

apply strict or absolute liability to all physical elements of a criminal offence;

permit an appeal from an acquittal;

deny procedural fairness to persons affected by the exercise of public power;

inappropriately delegate legislative power to the executive;

authorise the commission of a tort;

disregard common law protection of personal reputation;

give executive immunities a wide application;

restrict access to the courts; and

interfere with any other similar legal right, freedom or privilege

WARNING: Don’t attempt a drinking game with this list as you may succumb to acute alcohol poisoning before reaching the end.

Australia's future water security losing out in the water wars

ABC News, 24 July 2017:

Billions of litres of water purchased by taxpayers to save Australia's inland rivers is instead being harvested by some irrigators to boost cotton-growing operations, in a policy failure that threatens to undermine the $13 billion Murray-Darling Basin Plan.

The pumping of this environmental water means taxpayers have in some cases been effectively subsidising already wealthy agricultural interests, including those of Webster Limited, a publicly-traded company which holds a $300 million water portfolio — the largest Australian-owned private holding in the country.

A Four Corners investigation has found that in the Barwon-Darling system — a critical link in the wider Murray-Darling Basin — NSW Government water extraction rules have given irrigators more reliable access to water than prior to 2012 when the Basin Plan was signed.

Long-time farmers' advocate Mal Peters, who chaired a Murray-Darling Basin Authority (MDBA) statutory committee examining the Barwon-Darling, described the rules as "bloody disgusting".

"It rendered the whole plan, in my mind, completely null and void because the amount of water that could be taken out was huge," he said.

University of New South Wales scientist Richard Kingsford said the revelation "goes against the whole tenet of the [Basin] Plan".

"Environmental water bought by taxpayers is going through pumps into storages to grow cotton, and to me that is the biggest problem that we've currently got," he said.

Between 2012 and June this year, more than 74 billion litres of environmental water has flowed into the Barwon-Darling system — including when the controversial 2012 extraction rules allowed irrigators to pump it.

The Murray-Darling Basin Authority is explicitly aware of these concerns.

In July last year, the MDBA board held private discussions on the problem.

Board member George Warne emailed minutes from this discussion to other board members, including Phillip Glyde, the MDBA chief executive.

His email, seen by Four Corners, described the policies in the Barwon-Darling as an issue which "appears to enable gaming of water extractions ... enabling much higher use of water".

The email also acknowledged "water use behaviours that effectively mine the E-flows that make it into the Barwon-Darling".

These "E-flows" are those that taxpayers had purchased through so-called "buybacks" to save the river system.

Since John Howard announced the Murray-Darling initiative, taxpayers have spent more than $3 billion on water buybacks.

Graziers and townspeople downstream who rely on the river have expressed anger and dismay at the extraction rules, claiming they have seen the river diminish since the new policies were introduced in 2012.

This is what the Murray-Darling Basin Authority states of itself:

With the enactment of the Water Act 2007, the Murray–Darling Basin Authority (MDBA) was established as an independent expertise-based statutory agency.

For the first time in the Basin's history, one Basin-wide institution is responsible for planning the Basin's water resources, with all planning decisions made in the interest of the Basin as a whole….

We are responsible for directing the sharing of the River Murray's water on behalf of the Basin states. The Murray–Darling Agreement, (a schedule of the Water Act 2007) spells out these arrangements.

Under the Agreement, we operate the River Murray system and oversee asset management (Dartmouth and Hume Dam, Lake Victoria, Lower Lake barrages, weirs and locks) with our state partners.

The Authority has over three hundred employees and is headquartered in Canberra.

As the MDBA declares it is responsible for planning decisions and directing water sharing its governing body and the federal water minister have some explaining to do.

The six member Murray–Darling Basin Authority governing body having responsibility for the authority living up to its mandate:

Neil Andrew AO (Chair) – former Liberal MP in the federal parliament, current Chairman of the Crawford Fund in Australia and Commissioner to the Australian Centre for International Agricultural Research

Phillip Glyde Chief Executive – former Deputy Secretary at the Department of Agriculture

Professor Barry Hart – director of environmental consulting company Water Science Pty Ltd and emeritus professor at Monash University

Ms Dianne Davidson – farmer, agricultural scientist and horticulturalist

Mr George Warne – current chairman of construction company Lipman Pty Ltd, former CEO and Project Director of the Northern Victorian Irrigation Renewal Program, former general manager at Murray Irrigation Limited and former CEO State Water New South Wales

Ms Susan Madden – a principal economist at international consulting firm GHD Pty Ltd engineering, architecture, environmental and construction services to private and public sector clients

Portfolio responsibility for the MDBA is held by Australian Deputy-Prime Minister, Water Minister, and Nationals MP for New England Barnaby Joyce.

Aside from the limitations imposed by having the inept Barnaby Joyce as water minister, a hint as to why this body appears to be dragging its feet over the issue (of improper use of ‘buy back’ and state-gifted waters earmarked for environmental flows) might be found in this exchange previously reported by “Four Corners”.

This is what George Warne said in 2003 in answer to the statement That's the fear from environmentalists though that actually water saved will simply be used for more irrigation:

For better irrigation and for better farming. I mean I just I'm sorry I can't see what's evil about that, I have real trouble understanding why anyone would object to a farmer using the water smarter and better to grow more crops and do it better, I mean has the world gone mad.

This attitude is far from unique and threatens the Murray-Darling Basin Plan.

ABC

News, 24 July

2017:

The top water bureaucrat in NSW, Gavin

Hanlon, has been secretly recorded offering to confidentially share internal

government information with irrigation lobbyists — documents he proposed to

strip of government logos and share via a special Dropbox account — to assist

their lobbying against the contentious Murray-Darling Basin Plan.

The recording of the 2016

teleconference also reveals the NSW Government has been actively considering

plans, in discussion with irrigators, to abandon the Basin Plan altogether, and

has sought legal advice about doing so.

A Four Corners investigation has confirmed

that Mr Hanlon, Deputy Director General of the NSW Department of Primary

Industries, did not approve a major operation targeting non-compliant

irrigators in the north of NSW — an operation urged upon him by his own

investigators after they collected evidence that billions of litres of water

had been improperly pumped.

"I think that it was clear that

there was no appetite for compliance anymore," said Jamie Morgan, who

until midway through 2016 managed the department's Strategic Investigations

Unit.

"It was odd timing in my view. It

was only when we went to the north-west of the state, where we found

significant problems, that our team was very quickly disbanded after that.

"Our briefings weren't being

answered. And to this day, no-one has actually addressed those issues in that

area."

The principal connnection 180 year-old Webster Limited now has to Murray-Darling Basin land under Corrigan is the 200,000 megalitre water entitlement it harvests and can sell-off at will for maximum profit.

Nor should it come as any surprise that the NSW Berejiklian Government supports Corrigan and Webster as well as the other water raiders under the guise of supporting "real world" decisions.

It should come as no surprise that at the heart of the biggest gamer of the Murray-Darling Plan, Webster Limited, is that epitome of far-right, free market greed Chris Corrigan who is this corporation's Chair.This secret recording captures New South Wales’ top water bureaucrat offering internal government information to irrigator lobbyists. pic.twitter.com/TfNUqygXsn— 4corners (@4corners) July 24, 2017

The principal connnection 180 year-old Webster Limited now has to Murray-Darling Basin land under Corrigan is the 200,000 megalitre water entitlement it harvests and can sell-off at will for maximum profit.

Nor should it come as any surprise that the NSW Berejiklian Government supports Corrigan and Webster as well as the other water raiders under the guise of supporting "real world" decisions.

North Coast Voices readers may recall that irrigators, mining corporations and local governments in the Basin region have more than once turned rapacious eyes towards the NSW Northern Rivers, proposing to dam and divert coastal waters for their use.

Saturday 29 July 2017

Just because in is beautiful........(30)

Labels:

Australia

Tweet of the Week

“You just have to get poor people in this grip, and squeeze them.”https://t.co/zIrPJ2X6mU— Richard Chirgwin (@R_Chirgwin) July 20, 2017

Labels:

Malcolm Bligh Turnbull

Friday 28 July 2017

One Nation Senator Malcolm Roberts' British citizenship renunciation timeline not clear

On Sunday 8 May 2016the Prime Minister announced there would be a federal election on 2 July that year.

Writs were issued on 16 May and the rolls closed 23 May 2016.

At 12 noon on Thursday 9 June 2016 close of

nominations for both House of Representatives and Senate candidates occurred.

Early voting commenced on 14 June and Election Day ended at 6pm on 2 July 2016.

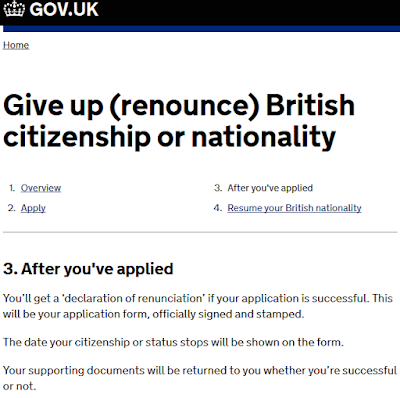

According to One Nation Senator Malcolm Ieuan Roberts as reported in The Age on 27 July 2017; he wrote to the British

authorities on May 1 last year to ask them whether he was a British citizen,

given he was born to a Welsh father in India.

However, this tweet by Chief Political Correspondent, Sydney Morning Herald & The Age, James Massola, throws Malcolm Roberts assertion that he was not a British citizen at the time of nomination into doubt.

It appears that U.K. authorities and Mr. Roberts may possibly have different views of when he ceased to be a British citizen.

I strongly suspect that the High Court of Australia would be inclined to accept the word of the U.K. Government over that of Malcolm Roberts if this difference is confirmed.

He says he got no

response so he wrote a further email on June 6 - three days before nominations

closed - saying that if he was a citizen he fully renounced. He subsequently

nominated as a candidate and won a Queensland Senate seat.

However, this tweet by Chief Political Correspondent, Sydney Morning Herald & The Age, James Massola, throws Malcolm Roberts assertion that he was not a British citizen at the time of nomination into doubt.

It appears that U.K. authorities and Mr. Roberts may possibly have different views of when he ceased to be a British citizen.

I strongly suspect that the High Court of Australia would be inclined to accept the word of the U.K. Government over that of Malcolm Roberts if this difference is confirmed.

Subscribe to:

Posts (Atom)