This table formed part of the council application:

Tuesday, 31 May 2016

Clarence Valley taken down a peg by IPART in 2016

Clarence Valley Council website, accessed 24 May 2016:

At the 24 November 2015 Extraordinary Council meeting (Item 12.060/15), Council resolved to apply for a Section 508A SRV of 6.5% p.a. (including the rate peg limit) for 5 years commencing 1 July 2016, which is a cumulative increase in ordinary rates of 37% by year 5 (2020-21) of the SRV (with the cumulative increase permanently built into the general rate after the 5 year SRV period has ceased). Council notified IPART on 25 November 2015 of its intent to make an SRV application of that nature. The additional income from the SRV above the rate peg as per Item 12.060/15 is to be spent on roads and roads related infrastructure renewals and maintenance to address the significant infrastructure backlog and maintenance gap for this group of assets.

In May 2016 Clarence Valley Council submitted an amended application to the Independent Pricing And Regulatory Tribunal (IPART) for this special rate variation (SRV) which was to be permanently retained in the rate base and also applied for a minimum rate increase (MR).

This table formed part of the council application:

This table formed part of the council application:

Clarence Valley residents made at least 169 submissions to council on this proposed rate increase and sent in a 115 signature petition. Only 3 submissions were in support of the rate increase. While IPART received 56 submissions (including one petition with around 2,000 signatures and 268 online submissions) opposing Clarence Valley Council’s application.

On 17 May 2016 IPART announced approval of the application for a SRV increase for the 2016-17 financial year only. This represents a 4.7% rise above the rate peg.

Council’s MR application was not approved. On 1 July 2017 the rate increase will be removed as per IPART’s instructions and therefore average rates will decrease.

According to the IPART Determination:

The application was not approved in full because it did not satisfy criteria 1 and 2 of the Guidelines. The council did not adequately justify the extent of the need for the proposed special variation, as the effects of additional revenue and cost savings previously adopted by the council were not included in the IP&R documents (or presented to the community). Secondly, the annual and cumulative cost impacts of the proposed rate increases were not adequately communicated to the community…..

The council’s ‘Base Case’, in its adopted IP&R documents, understates the available revenue and therefore overstates the financial impact of, and the need for, the special variation…..

The increased income from user charges and fees were included in the LTFP adopted by the council on 23 June 2015 and should have been included in the ‘Base Case’ used for community consultation on the special variation (in August and September 2015). Similarly, the efficiency cost savings adopted by council on 24 November 2015 should have been included in the ‘Base Case’ included in the Revised LTFP adopted 9 February 2016, which formed the basis of the special variation application.

The council amended its application to IPART in April 2016 and May 2016 to include these measures in its ‘Base Case’, however this followed the completion of the community consultation process. In excluding the additional user charges and fees and efficiency savings from the ‘Base Case’, the council did not adequately inform and make the community aware of the financial impact of the proposed special variation…..

In 2015 the council reviewed its IP&R documents in consultation with the community. It clearly explained the purpose of the proposed special variation and provided reasonable opportunities for community feedback. However, we are not satisfied that the community was provided with:

* adequate opportunity to consider the need for the special variation, as a result of the positive effects of the additional revenue and cost savings previously adopted by the council, which reduce the need for, and extent of, the rate increase required to achieve financial sustainability, and

* adequate information about the extent of the annual and cumulative financial impact of the proposed rate increases over the five years of the special variation….

IPART’s decision means that Clarence Valley Council may increase its general income in 2016-17 by an estimated $1.8 million including the rate peg.

Out of the ten councils who applied for rate increases this year, Clarence Valley Council was the only one which didn’t get all it asked for.

Perhaps that will tell this particular council something about how inadequate is its approach to community consultation and revenue raising.

Though I am quite sure that ratepayers across the valley are hugely relieved that it was found to be so inadequate by the folk in Sydney.

Of course Clarence Valley Council can apply for a special rate variation again in 2017-18 and perhaps the next time around management will allow Council in the Chamber a chance to consider its final formal written application to IPART before it is submitted.

Summoning up "the old Malcolm"

For some reason certain commentators and voters appear to believe that Malcolm Bligh Turnbull had to fundamentally change in order to be elected Prime Minister of Australia by the Liberal Party.

Nothing Turnbull has done since 1 December 2009 when his party dumped him as opposition leader indicates that any change has occurred.

Basically what one sees is what has always been there – a hugely egotistical man, driven by ambition, who believes the misleading ' poor boy' backstory he created about his own life and who has little to no knowledge of the hopes, dreams, concerns and daily lives of ordinary people and cares even less.

In other words, we see this…….

Monday, 30 May 2016

Australian Federal Election 2016: polling at the beginning of Week 4 of the campaign

News.com.au, 28 May 2016:

Three weeks into the two-month campaign, the 7News-ReachTel poll, released on Friday, has Labor ahead 52-48 on a two-party preferred basis.

Earlier in the week Newspoll and Essential had Labor leading the coalition 51-49 per cent, reversing the Fairfax-Ipsos result from the previous weekend.

For those who place more faith in the punters here are Sportsbet markets covering NSW Northern Rivers at 8am 29 May 2016:

Sitting Nationals MP Kevin Hogan since 2013 vs Labor candidate Janelle Saffin

Sitting Labor MP Justine Elliot since 2004 vs Nationals candidate Matthew Fraser & The Greens Dawn Walker

Sitting Nationals MP Luke Hartsuyker since 2001 vs candidate “Any Other” & Labor’s Alfredo Navarro

Labels:

Federal Election 2016,

gambling,

politics,

poll,

statistics

Australian Federal Election 2016: oh the pain, it burns!

I’m sure there is more than one voter on a low income who is chortling about what went down in Week Three of the federal election campaign.

This has been the state of play for members of the Australian Parliament since 1999.

Excerpts from TR 1999/10 Taxation Ruling Income tax and fringe benefits tax: Members of Parliament – allowances, reimbursements, donations and gifts, benefits, deductions and recoupments:

10. Members commonly receive the following types of allowances, in addition to their Parliamentary ‘salaries’ (see paragraphs 42 to 45). Particular allowances may vary depending on the Parliament in which a Member serves.

• Committee allowance

• Daily expense allowance

• Electorate allowance

• Expense or entertainment allowance

• Opposition spokespersons’ allowance

• Postage allowance

• Printing and stationery allowance

• Private vehicle allowance/motor vehicle allowance

• Telephone allowance

• Travel allowance.

These allowances, like MPs and senators parliamentary salaries, are considered assessable income by the Australian Taxation Office.

Second property not used as a Member’s residence: A deduction is allowable for expenses of a non-capital nature, and for depreciation of plant, where the property is not properly regarded as a second residence. However, the deduction is limited to the extent to which the expenditure is incurred in respect of a property that is used by a Member for work-related travel purposes on overnight stays away from his or her residence, and the expenditure is not private or domestic in nature (paragraphs 328 to 336).

Second residence expenses: A deduction is not allowable for the costs of maintaining a property that is used as a second residence (paragraphs 337 to 343)……

These two sections of the ruling appear to allow parliamentarians to double-dip at the ordinary taxpayers expense – first using the overnight travel allowance to pay down the mortgage on a Canberra residence if it’s not owned outright and then claiming tax deductions including mortgage interest, rates, insurance and utilities on the same residence.

Then this cosy little arrangement became public knowledge…….

News.com.au, 22 May 2016:

TAXPAYERS are helping to pay the mortgage and the rent for federal MPs who are raking in $1000 a week to sleep in Canberra and then, on top of that, claiming a big tax deduction for rent, rates, electricity and mortgage.

In a little-known tax ruling, MPs who rent can also claim a tax deduction for a second residence including “lease payments; rent; interest on borrowings used for the acquisition of the property; rates; taxes; insurance; general maintenance of the building, plant and grounds’’.

Finance Minister Mathias Cormann, charged with cracking down on budget waste, is just one of the MPs double-dipping by claiming a $273-a-night travel allowance (which, bizarrely, is not regarded as taxable income) and scoring a tax deduction as well….

The rules state that an MP “may choose to rent or buy a property rather than stay in a hotel or other commercial establishment when travelling. A deduction is allowable for expenses, that are not of a capital, private or domestic nature, in respect of such a property where it is used by a Member for accommodation when he or she is undertaking work-related travel.

“Such expenses include: lease payments; rent; interest on borrowings used for the acquisition of the property; rates; taxes; insurance; general maintenance of the building, plant and grounds.’’

The Guardian, 22 May 2016:

The finance minister, Mathias Cormann, has defended politicians receiving both a $273 a night travel allowance and tax deductions for mortgages and rents for properties in Canberra.

Speaking on Insiders on Sunday, Cormann said the remuneration tribunal granted the travel allowance and the tax office allowed deductions for politicians’ accommodation expenses.

Federal politicians receive $273 a night to stay in Canberra, a travel allowance they can claim even when they stay in a property that they or their partner own.

Reports have revealed that on top of the allowance, MPs who rent or buy a property to stay in during work-related travel can also claim tax deductions for rent, interest on borrowings used for the acquisition of the property, rates, taxes, insurance and general maintenance.

The first report indicates that some federal politicians may be under the impression that a travel allowance paid for a presumed expense was not taxable income.

Then came this painful revelation……

ABC News, 23 May 2016:

Tax Commissioner Chris Jordan stressed that members of Parliament had to abide by the same standards as everyone else.

"The rules are the same for every taxpayer, regardless of their occupation," Mr Jordan said in a statement.

"Any taxpayer who has had to travel overnight for work is entitled to deduct the costs of meals and accommodation under our tax laws.

"However, given that there are clear misunderstandings of how the ruling is applied, we will undertake to review the 1999 ruling to give greater clarity for all taxpayers on the treatment of allowances they may receive from their employer to cover the costs of work related travel."

The ATO said the returns of all taxpayers, including MPs were scrutinised, and that any taxpayer should not be claiming deductions for travel expenses unless they have declared the allowance as income in their tax returns.

In 1999, the ATO issued a ruling about how it assesses travel allowances and tax deductions for MPs.

That ruling will now be reviewed in light of the issue being thrust into the campaign spotlight.

Sunday, 29 May 2016

Gillian Mears July 1964 - May 2016, a Clarence Valley girl

Old Copmanhurst by the late great author Gillian Mears in Meanjin Volume 71 Issue 1 2012

Much exclamation occurs when people realise Foal’s Bread is my first novel in sixteen years. Sixteen years ago I was about to turn thirty-one. From this distance that seems inconceivably young and I was inconceivably bewildered that only horses understood that something horrible had begun to happen in my legs and feet.

I can clearly remember how for that birthday I rode my brown mare Bellini down as usual to my father’s letterbox on Old Copmanhurst Road. Although the advance author copies of The Grass Sister had arrived early, far from any feeling of luck that they’d landed in the letterbox on my birthday, only dismay was sweeping through me. Whereas a few weeks before I could’ve vaulted back onto my horse with my backpack full of mail, on that day it had become a difficult scramble.

The multiple sclerosis that would defy diagnosis for another seven years was slowly but surely taking away my ability to ride even the quietest pony, let alone Bellini, my loveliness Wind of Song ex-barrier rogue, rescued by my eldest sister Yvonne from the brutality of a Brisbane track for me to purchase.

I felt a growing sorrow that as the mystery progressed, less and less chance existed for those moments when my own soul could meet my mare’s through a long pair of favourite old leather reins. My grief at seeing her sold wasn’t unconnected to the fact that whatever was happening in my body was inexorably also severing my links with my own horse-loving family….

On 1 January 2009 the realisation dawned that Yvonne might never send out her book. I could wait no longer. My wholehearted attempts to write first a play and then a wisdom cat fable had, against all expectation and effort, utterly failed. Now I felt in a race with myself. In honour of Stow’s claim that fuelled by pork pie he wrote all his novels fast, I resolved to have a final draft of Foal’s Bread finished by the first day of spring. Memories of that kind of Newton Boyd country west of Grafton but before the Great Dividing Range, informed my writing days.

Even though I was thousands of miles away from the Clarence River, ghosts of horses of the past seemed to walk right into my writing room. When I’d typed the draft of each week’s chapter onto my computer I even developed the habit of throwing a cloth over it and the printer, as if they were horses to be rugged before nightfall. Then I could practically feel the warmth of a horse. I could feel that I really was clipping up the back legs straps of a rug as a cold wind sprang up off the river….

Read the rest of the story here.

Labels:

arts

It's not just the Clarence Valley that harasses its bats

21 May 2016

Greg Hunt MP has granted a sthn NSW Shire council exemption from Australia's enviro law (EPBC) so it can harass/kill/burn/disperse the migratory colony of threatened wildlife - notably the Grey-headed Flying Fox. What precedent does this set for every other town along the east coast to demand an OK to mass kill this threatened species because a handful of people are frightened of bat poo. This is hardly 'in the national interets'.

Flying foxes are a 'keystone species'; they play a vital role in our ecosystem, a species upon which many other plants and animals depend.

'Ecosure' is the most experienced flying-fox management consultancy in Australia and has been involved in numerous dispersal programs. Their report to the government on this said it is the highest risk dispersal scenario they have assessed...

Dispersal activities have unpredictable outcomes, are very costly, require ongoing commitment and maintenance, are often not successful and rarely achieve desirable outcomes for all stakeholders. Dispersal also often leads to flying-fox stress, injuries or fatalities, and may lead to increased human and animal health risk...

Removing their protection is an act so remiss in its duty of care to vulnerable species that it will one day be referred to as “catastrophic".

https://www.change.org/p/protection-of-the-vuln…/u/16625192…

and here @GregHuntMP proudly tells the world he is happy to see thousands of threatened Flying Foxes harassed, stressed and killed off to stop 'residents suffering' from the bat's happy chatter and droppings.

http://www.greghunt.com.au/…/Coalition-Plan-To-Tackle-Batem…

Flying foxes are a 'keystone species'; they play a vital role in our ecosystem, a species upon which many other plants and animals depend.

'Ecosure' is the most experienced flying-fox management consultancy in Australia and has been involved in numerous dispersal programs. Their report to the government on this said it is the highest risk dispersal scenario they have assessed...

Dispersal activities have unpredictable outcomes, are very costly, require ongoing commitment and maintenance, are often not successful and rarely achieve desirable outcomes for all stakeholders. Dispersal also often leads to flying-fox stress, injuries or fatalities, and may lead to increased human and animal health risk...

Removing their protection is an act so remiss in its duty of care to vulnerable species that it will one day be referred to as “catastrophic".

https://www.change.org/p/protection-of-the-vuln…/u/16625192…

and here @GregHuntMP proudly tells the world he is happy to see thousands of threatened Flying Foxes harassed, stressed and killed off to stop 'residents suffering' from the bat's happy chatter and droppings.

http://www.greghunt.com.au/…/Coalition-Plan-To-Tackle-Batem…

NOTE: The Grey-headed Flying Fox is listed as Threatened in Victoria, Vulnerable in New South Wales and Rare in South Australia.

Saturday, 28 May 2016

Quotes of the Week

Policy decisions taken since the 2016-17 Budget have worsened the underlying cash balance by around $1.8 million in 2016-17…..

[Australian Treasury and Dept. of Finance, Pre-election Economic and Fiscal Outlook 2016]

"F--- them. If you care about books, don't vote Liberal."

[Author Richard Flanagan at the Australian Book Industry Awards, quoted in The Sydney Morning Herald, 20 May 2016]

Joke of the Week

A tired old swaggie is trudging along one of the dusty backroads, back o' Bourke. She's just gorn 2 o'clock, about 110 degrees Fahrenheit in the shade, the blowies are shocking and his swag feels like a bag of wet wheat. His back aches, the sweat is pouring off him and the soles of his one pair of boots have more holes than leather.

And now, from way behind him in the distance he sees a ball of dust approaching along the road at great speed. The swaggie stops, lays down the swag and wipes his brow as the car pulls to a halt beside him.

It's a brand new ute driven by the biggest property owner in the district – the only bastard in two hundred mile who smokes cigars. He winds down the passenger-side window as the swaggie savours the sudden lovely cool of the ute's air-conditioning running at full blast.

"Hop in, mate," says the filthy-rich Cockie, "Too hot to walk. I'l give yer a lift."

The swaggie pauses, slowly looks the car up and down, then turns his gaze on the driver and says, "Nah. Open your own bloody gates."

[Peter Fitzsimmons, The Sydney Morning Herald, 15 May 2016]

Friday, 27 May 2016

Euen denies his unrealistic plan for a "Yamba Super-Port" includes a coal loader or bauxite moving through the port

An short anonymous online snippet under the pen name "Maclean" in The Northern Star on 14 April 2016 included this photograph of Desmond John Thomas Euen (far left) with the Australian Deputy-Prime Minister and MP for New England Barnaby Joyce:

The photograph appears to have been taken at one of the Lismore bowling clubs on an unspecified date and the published snippet (possibly penned by Mr. Euen himself) contained no real details of what the dour former Queensland truck driver told Barnaby Joyce about his personal plan for the small Port of Yamba.

However, a local reader told me on 25 May 2016 that when contacted Des Euen is once again "emphatically" denying there will be any facilities for coal loading in his plan for Yamba and that coal and bauxite will not be going through the port.

The photograph appears to have been taken at one of the Lismore bowling clubs on an unspecified date and the published snippet (possibly penned by Mr. Euen himself) contained no real details of what the dour former Queensland truck driver told Barnaby Joyce about his personal plan for the small Port of Yamba.

However, a local reader told me on 25 May 2016 that when contacted Des Euen is once again "emphatically" denying there will be any facilities for coal loading in his plan for Yamba and that coal and bauxite will not be going through the port.

He claimed to this local reader that there had never been any plans for a coal loader or for bauxite to move through the port.

Des apparently said “no coal loading facilities”, “no bauxite loading facilities” and “that has always been the case.”

But only one week before his denial at least one version of the invitation to the so-called "summit" in Casino posted online by Euen included the statement: ”The dual capacity of Yamba Port and Pacific West Rail to provide a viable alternative route for the carriage of mineral resources emanating from Northern NSW and the lower section of the Surat Basin".

On 25 May that 4 May 2014 dot point was also still up on the AID Australia Pty Ltd website:

In his presentation to Moree Plains Shire Council on 12 June 2014 Euen is clearly expecting that his proposed rail network will potentially carry ore from the Muswellbrook, Glen Innes and Narromine rail heads to the Port of Yamba:

On 9 February 2015 and again on 26 May 2016 this dot point was sighted by North Coast Voices on the AID Australia Pty Ltd website:

Readers have been tracking some of the text changes Euen makes to the AID Australia website and are of the opinion that reference to a coal port found at http://www.aid-australia.com.au/competitive-edge/ is no longer directly accessible from the 'company' website homepage and is no longer included in the AID Australia's A “Key” Nation Building Infrastructure Plan Summit invitation.

Reference to the possibility that bauxite would be loaded from this new Yamba Super-Port can be found on the Australian Stock Exchange website where a gullible Queensland Bauxite Limited told the world it had been in talks with Mr. Euen.

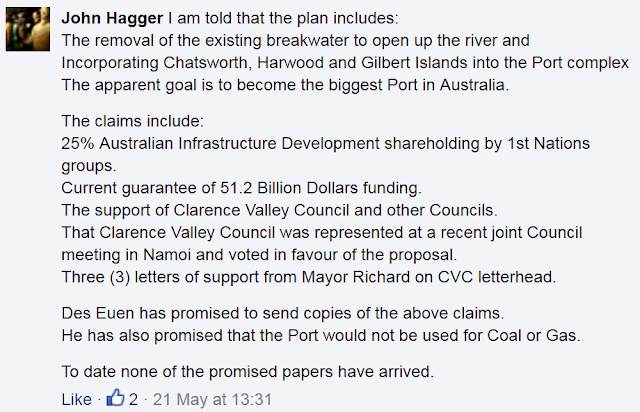

Des Euen has also given similar assurances (no coal and no gas) to a member of the Clarence Forum:

Des Euen has also given similar assurances (no coal and no gas) to a member of the Clarence Forum:

NOTE: Mayor Richie Willaimson has again denied he supports Euen's port expansion plan.

To be frank, to date in the Lower Clarence there is scant belief in Des Euen's facile assurances about his personal plans for Yamba.

Plans which he has never deigned to publicly present and explain to the Yamba community - perhaps because he is afraid that his grandiose phantasy would be blown out of the water by local knowledge of the Clarence River, its estuary, physical environment and coastal approaches.

Plans which he has never deigned to publicly present and explain to the Yamba community - perhaps because he is afraid that his grandiose phantasy would be blown out of the water by local knowledge of the Clarence River, its estuary, physical environment and coastal approaches.

Labels:

Clarence River,

coal,

environmental vandalism,

gas industry,

mining,

Port of Yamba

Journalist Paul Bongiorno on the subject of Tony Abbott's comeback ambitions in 2016

ABC NEWS: MP for Warringah Tony Abbott’s 2016 federal election campaign launch

The New Daily, 16 May 2016:

Just ask yourself this: what other backbench member of parliament could attract all the TV networks, extensive radio coverage and print reporters to their local campaign launch?

Only a deposed prime minister keen to keep his name up in lights and intent on a comeback would be capable of the feat.

Tony Abbott’s Warringah launch had all the trappings of a national event. In fact, it had more razzamatazz than Julia Gillard’s 2010 effort, complete with a giant national flag back drop, professional placards and rows of blue t-shirted supporters.

It was followed with extensive interviews on Sky TV and with high-rating Sydney shock jock Alan Jones. And he is not up to mischief?

It is a free country and he successfully sought Liberal endorsement fair and square. But just as Malcolm Turnbull didn’t hang around in politics to be anything other than Prime Minister, it is surely not beyond the pale to ask why Tony is clinging to his parliamentary career. A lack of imagination doesn’t cut it. To serve the people of his electorate and the nation sounds, well, self-serving.

This is where the game of politics, the rules of engagement and appearances have to be well understood. Mr Abbott has assured his sympathetic media interrogators his party would never turn to him again as leader. His former chief of staff Peta Credlin scotched that one. That’s what he may be thinking now, she says, but experience tells us there’s no such thing as never ever.

Especially as a significant number of Liberals both in and out of the parliament are beginning to worry that Mr Turnbull is just not the politician he needs to be to maximise the government’s position either in the election, or if he should just win it, after the poll.

In fact there is a belief – more a shuddering fear – that the Coalition could be left with a bare majority at best.

“Anything under 80 seats spells doom for Malcolm,” was the view of one disconsolate Liberal MP. Seventy-six are needed to form government.

If perceptions of dithering and drift continue, and the government’s standing worsens, the precedent is set for a coup…..

Thursday, 26 May 2016

Former Australian Treasurer Joe Hockey's 'gift' to all property owners across the nation

Australian Financial Review, 13 August 2015

The Australian, 19 May 2016:

The current mess was created when former treasurer Joe Hockey caved into pressures to curb Chinese investment in Australian residential property in 2015. In the process, the treasurer was convinced by the Australian Taxation Office to widen the net to cover local residents.

Parliament was being bombarded with tax legislation at the time and the Canberra politicians did not pick up what the ATO had done.

So, fasten your seats belts for a horror commentary.

I was alerted to the position by one of Australia’s top commercial/tax barristers, John Fickling of WA. I am using many of Fickling’s words in describing what is about to happen.

If you purchase a property worth $2m or more on or after July 1 2016, you will be required to withhold 10 per cent of the purchase price and remit it to the ATO UNLESS the vendor is able to provide a special purpose tax resident’s “clearance certificate” from the ATO. It does not matter if the vendors were born in Australia and have lived all their lives in Australia — unless they have that clearance certificate, they are classed as a foreigner and the buyer must send 10 per cent of the purchase price to the tax office.

In case you think I’m kidding, read the ATO’s exact words: “A vendor who sells the following assets is also a relevant foreign resident, even if they are an Australian resident for other tax purposes.

The definition of property is very wide and includes leaseholds but does not include stock exchange investments. A purchaser who does not receive a “clearance certificate” from the vendor and does not send 10 per cent of the purchase price off to the ATO will still be liable to pay that 10 per cent to the ATO plus, almost certainly, will have to pay severe additional penalties and interest. The economics of buying the property will be severely damaged.

Fickling says all real estate agents selling $2m plus properties should be considering how this new regime will impact on their business and what will be the contractual consequences under the different scenarios that could play out.

For example, banks and other financiers may be affected where their secured debt exceeds 90 per cent of the value of the selling price. In a situation where the owner is being forced to sell, the banks will be better to take possession and sell themselves rather than being caught in the “tax clearance” delays.

To be fair, in the vast majority of cases local resident vendors will have no problem obtaining a “clearance certificate”.

However, for locals it might increase their risk of a tax audit and there are clear hazards for property sellers who:

Have not filed tax returns for many years;

Have filed tax returns, which would indicate they could not afford such a property;

Are selling their residential house at the same time as their neighbours to a single developer, which may give rise to a profit making scheme (such that the principal residence capital gains tax exemption may not apply to the value uplift generated by selling the properties together); or

Where the ATO has gathered information that indicates the vendor is in the business of developing property, which means that the principal residence capital gains tax exemption may not apply.

Fickling says in extreme cases action could potentially be taken by the ATO prior to the sale, to freeze the transaction.

Those who see any of the above as dangers might consider selling in a hurry (before July 1), so there might be some property bargains for buyers in coming weeks.

It’s also important to note that the $2m is “hard-coded” into the legislation, so, as property prices increase, more vendors will be caught. Over time, the ATO may shift their audit target identification processes to $2m-plus property vendors and away from other areas.

Additionally, if the vendor has a tax debt, the application for a “clearance certificate” may in some circumstances involve the ATO seeking to recover some or all of that tax debt from the purchaser by way of a garnishee notice.

At this point, it is worth noting that we are giving the Australian Taxation Office another weapon to recover tax legitimately owed and that is a good thing for society.

The great danger is the complexity created and that currently the tax office is badly run and is operating outside the law in key small business areas. It knows it can’t be challenged because of the cost of court cases.

Meanwhile, the legislation is yet another blow being aimed at Chinese and other Asian investors in property. These blows have come separately and each one has had reasonable motivations. But, in combination, they could inflict severe damage to the apartment and other parts of the residential property market.

Chinese and other Asian investors face a Hobson’s choice. They will not enjoy getting a tax clearance but nor will they appreciate the buyer of their property taking 10 per cent off the purchase price.

And if the tax office treats locals illegally, what might they do to foreigners?

Australia desperately needs greater independent supervision of the tax office.

In case readers imagine that high property prices are confined to large metropolitan areas a quick look at realestate.com.au will dispel that view – within the NSW Northern Rivers there are currently 7 properties in Yamba and environs with a sale value of $2 million and over, 4 in the Grafton area, 6 in Kyogle, 9 in the Lismore region, 35 in the Ballina district, 78 in the Byron Bay greater region and 46 in the Tweed local government area.

Labels:

Abbott Government,

ATO,

Federal Election 2016,

housing,

taxation

Australian Federal Election 2016: alleged corruption in Border Force ranks

Prime Minister Malcolm Turnbull

17 May 2015

The Age, 19 May 2016:

A network of Australian border security officials is allegedly working for organised criminals, including drug and tobacco smugglers, in the most serious corruption scandal to ever hit the nation's border agencies.

A Fairfax Media investigation has uncovered multiple cases of alleged corruption involving staff from the Australian Border Force and the Department of Agriculture, along with maritime industry employees with government clearances…..

The allegations come as the government makes a virtue of its strength on border security, with Prime Minister Malcolm Turnbull claiming the opposition "lack the commitment to keep our borders secure".

However, the federal government and customs chiefs, including the nation's top border security official, Michael Pezzullo, have been repeatedly warned over four years in high-level confidential briefings about significant suspected corruption in the Border Force's ranks, especially in NSW.

Evidence, including NSW police briefing notes and testimony from crime figures, suggests that one of the most vital border security facilities, the NSW Customs Examination Facility, has been compromised by corrupt insiders, enabling criminals to import large amounts of drugs and tobacco undetected. Staff at the facility are responsible for searching containers suspected to contain contraband.

A small network of Department of Agriculture officials responsible for clearing imports into Australia have also been assisting and liaising with known drug traffickers for at least the past five years…..

Fairfax Media has delayed reporting on the border corruption scandal for several months at the request of authorities.

In NSW, evidence uncovered by Fairfax Media from multiple sources, including agency officials, government briefing files and figures with underworld ties, implicates Border Force officials in drug and tobacco trafficking, and leaking to the criminal underworld.

Criminal intelligence suggests one officer has been taking kickbacks of hundreds of thousands of dollars from traffickers, while another has been facilitating importations.

Suspected corrupt officers are still operating.

The latest scandal comes three years after a network of corrupt customs officers was identified at Sydney airport and charged by the federal police. At the time, Mr Pezzullo promised sweeping reforms, including many which have been implemented.

Top security and policing officials, along with corruption experts, called for the nation's federal police watchdog, the Australian Commission for Law Enforcement Integrity (ACLEI) to have its budget dramatically increased and said the Australian Border Force had failed to deal with corruption in its ranks.

Leading corruption expert and former senior judge Stephen Charles, QC, said ACLEI – which, with about 20 investigators out of a total of 55 staff, is among the smallest corruption fighting agencies in Australia – was badly outgunned. Mr Charles said Australia needed an anti-corruption agency with hundreds of staff……

One senior government source said the Australian Border Force was "incapable" of eradicating corruption in its ranks and sometimes dealt with internal integrity issues with departmental sanctions, such as demotion or sacking, rather than by conducting intensive probes that could expose corrupt networks……

Read the full article here.

One senior government source said the Australian Border Force was "incapable" of eradicating corruption in its ranks and sometimes dealt with internal integrity issues with departmental sanctions, such as demotion or sacking, rather than by conducting intensive probes that could expose corrupt networks……

Read the full article here.

* Photograph found at The Sydney Morning Herald

Wednesday, 25 May 2016

Immigration Minister Peter Dutton never lets facts get in the way of a good dogwhistle about demmed furriners

This was Australian Immigration Minister Peter Dutton quoted in The Sydney Morning Herald on 18 May 2016:

"They [refugees] won't be numerate or literate in their own language, let alone English," Mr Dutton said.

"These people would be taking Australian jobs, there's no question about that.

"For many of them that would be unemployed, they would languish in unemployment queues and on Medicare and the rest of it so there would be huge cost and there's no sense in sugar-coating that, that's the scenario."

Labor and Greens jeopardise refugee outcomes

Labor and Mr Shorten's arbitrary doubling of Australia's Refugee and Humanitarian Programme is all about politics and was a crass attempt to win over the left on boat turn backs.

About 70 per cent of Australia's migration programme is made up of skilled migrants and Australia's annual net migration figure is approximately 190,000.

In addition under the Refugee and Humanitarian Programme we accept 13,750 people per year. We provide services to applicants who by definition come from war-torn countries and situations where people face persecution.

Our Government provides significant funding on settlement services to help people within the humanitarian and refugee programme with services such as education, training, accommodation, English language lessons and trauma counselling.

Our programme grows gradually from 13,750 per annum. Labor's decision to just double the figure was done solely for political purposes. There was no science in doubling the figure – it was purely done to try to win over the Left during the debate at ALP conference on boat turnbacks.

Here are the facts on people coming in through the Refugee and Humanitarian Programme:

* 44 per cent of the female arrivals and 33 per cent of males do not understand spoken English prior to arrival

* 23 per cent of female arrivals and 17 per cent of males are illiterate in their own language

* 15 per cent have never attended school

* 46 per cent have never undertaken paid work

* 44 per cent of the female arrivals and 33 per cent of males do not understand spoken English prior to arrival

* 23 per cent of female arrivals and 17 per cent of males are illiterate in their own language

* 15 per cent have never attended school

* 46 per cent have never undertaken paid work

Data from the Building a New Life in Australia study, the Longitudinal Study of Humanitarian Migrants (BLNA) which remains ongoing, indicates that humanitarian entrants face considerable economic and social challenges to settling successfully in Australia. The BNLA found humanitarian settlers fill low skill and low paid occupations.

Other studies have found that humanitarian entrants generally have poorer employment outcomes than other migrants, particularly in their early years of settlement.

The Australian Census Migrants Integrated Dataset shows that for humanitarian entrants 32 per cent are recording as being 'in the labour force' while 45 per cent were 'not in the labour force'. The Australian Bureau of Statistics found that in March the general Australian population had a Labour Force Participation Rate of 65 per cent.

The Personal Income Tax Migrants Integrated Dataset indicates humanitarian visa holders reported income of around $25,000 well below the national average of just under $50,000 for Australian taxpayers.

During the data matching period less than 20 per cent of these humanitarian migrants submitted a tax return.

What this shows is that it is vital to be able to provide the housing, employment, health and integration services that provide the base for these migrants to build a new, happy, healthy and successful life in our country – a process that can take years, even a generation.

A doubling of the Refuge and Humanitarian Programme annually as committed to by Labor would cost an estimated $2.5 billion dollars over the four year period of the Forward Estimates.

The Greens proposal to quadruple the intake to 50,000 annually would come at an estimated cost of $7 billion dollars over the Forward Estimates.

Australia is already one of the most generous nations in resettling refugees.

We rank in the top three nations for providing permanent resettlement of those most in need from around the world.

Refugees and humanitarian entrants are selected not because they have skills, but because they face persecution or serious discrimination. Many will have been denied basic services such as health and education in their own country and will have suffered trauma or torture for years.

Given those circumstances, we should not be surprised that entrants under the Refugee and Humanitarian Programme need considerable and specialist long term support to settle into our country.

That is why the Government is committed so strongly to funding settlement services, but it comes at a cost.

The size and composition of the Refugee and Humanitarian Programme is carefully considered annually to ensure sufficient resources are available to successfully process and integrate those fleeing persecution.

The Labor/Greens proposals risk jeopardising settlement outcomes.

Australians support an organised migration programme; Australia is a nation of immigrants.

But the programme needs to remain manageable and acceptable to maintain that support from the broad Australian population. Australia has proudly and successfully resettled more than 825,000 refugees and others in humanitarian needs since World War II and we have the capacity to continue this generosity in a managed process.

To assert that virtually overnight you can double (Labor) or quadruple (The Greens) – on an annual basis – this intake of vulnerable people with many special needs is the height of irresponsibility and jeopardises the current community support for the refugee programme.

One only has to look at the influx of more than 50,000 people illegally on boats during the last Labor Government to see how unrealistic both the Labor and Greens proposals are.

The Department of Immigration and Border Protection will take at least the next three years to simply process these people.

The special intake of 12,000 Syrians and Iraqis from the war-torn Middle East will take a number of programme years, simply because we cannot cut corners in regards to the various checks, but particularly security checks, that we must carry out on people before we offer them the opportunity to resettle in Australia. The Government has committed over $800 million to this special intake alone.

We live in a dangerous and uncertain world in terms of security and we need appropriate processes in place to ensure we are assisting those most in need with the least prospect of returning to their previous lives.

One only has to look at the recent events in Europe to realise that secure borders and organised migration are vitally important to the security of any nation.

Only the Coalition is committed to strong border protection policies to keep Australia as safe and secure as is possible.

THE HON. PETER DUTTON MP

MINISTER FOR IMMIGRATION AND BORDER PROTECTION

MINISTER FOR IMMIGRATION AND BORDER PROTECTION

So what are voters supposed to conclude from this election campaign spiel?

Apparently it’s that we are all supposed to be concerned that refugees will take our jobs or become a burden on the welfare system because they are illiterate and unemployed.

What Peter Dutton is careful not to say about the incomplete longtitudinal study he is quoting is that it is examining the lives of 2,399 recently arrived humanitarian migrants – 64 per cent of whom had been in Australia less than six months and 83 per cent less than one year.

Anyone fleeing from war-torn countries to an essentially monolingual country (where unemployment is running at 5.8%) who finds permanent full-time employment in under a year is likely to be an exceptional person, so it is hardly surprising that in those first months on Australian soil a number are unemployed.

However, when it comes to looking at humanitarian refugees 15 years of age and over with labour force status recorded in the 2011 Australian Census, what Dutton does not mention is that (using New South Wales as the example) 79.34% of Iranians, 78.6% of Iraqis, 78.4% of Afghans and 66.3% of Sudanese were in employment.

Nor does he draw attention to the fact that those refugees classified as 'not in the labour force' would include children under 15 year of age. Of those recent humanitarian refugee units arriving in Australia 50% contained children.

Nor does he draw attention to the fact that those refugees classified as 'not in the labour force' would include children under 15 year of age. Of those recent humanitarian refugee units arriving in Australia 50% contained children.

As for recent humanitarian refugees having incomes of around $25,000 a year – well so do an est. 1.365 million other people according to Australian Bureau of Statistics published data.

One would have to be profoundly stupid to take Peter Dutton’s demmed furriners spray at face value.

Subscribe to:

Comments (Atom)